As of today (02-10-2016) there are 16,051,950 bitcoins out of 21 million that will ever be in circulation, priced at $604.05 each (that makes a total market capitalization around $9.7 billion). As a comparison, $9.7 billion is approximately equal to only 1.5% of Apple’s total market capitalization.

During next weeks, we will publish a mini-series of articles (composed out of three parts) in which we will try to explain how easy it is to manipulate a very small market such as the one of cryptocurrencies, in particular bitcoin.

In the first part we will focus on OKCoin.cn (OKC), Bitstamp.net (STMP) and BitFinex.com (BFX), which are the three most popular exchanges, perhaps the favorite among traders because of their rich features.

The bitcoin, hereinafter BTC market is unusual. It is traded against all major currencies but nearly 93.8% of all the trading volume in the last 6 months took place in Chinese Yuan (CNY) on OKC (51.9%) and two other exchanges, Huobi.com (37.1%) and Btcc.com (4.8 %). The average daily volume in CNY market is 1.5 million BTC. Differently from other conventional asset classes, BTC exchange trade continuously even on weekends and holidays, although on those days the volume is lower.

As you probably have already noticed there are many exchanges for bitcoin, which results in thin order books, reduced liquidity (because it is split across several venues) and harder price discovery.

There are several reasons for this very large volume of trading on the Chinese exchanges:

– they are commission free, which means that no fee is paid when an order is executed

– self-trade (a transaction in which the same user takes both sides of the trade) is possible.

These two facts explain how such high volumes can be easily achieved and also, it is the reason why many investors consider those volumes as unrealistic and generated in order to attract new users who care only about the volume.

Another method to rank exchanges relies on the depth of the order book (to be read as “liquidity”), thus the deeper (the more liquid) the better. Indeed, higher liquidity reduces significantly the risk of slippage when big orders are executed.

As it can be seen from the graph, the situation is changed and Chinese exchanges are less relevant than before; the new leaderboard is:

- BitFinex.com (BFX)

- Bitstamp.net (STMP)

- OKCoin.cn (OKC)

It is important to point out that we did not consider Gemini.com (ranked at the 3rd position), due to the fact that it gets most of its volume from an OTC auction block of 1,000-2,000 BTC held every day, not from continuous trading.

On the one hand, STMP is a simple spot exchange and there are no futures nor margin trading. On the other hand, BFX and OKC are somehow different. In fact, both BFX and OKC offer leverage (3x on BFX and 20x on OKC), futures trading and peer-to-peer financing to margin traders.

What does this mean?

It means that users can lend their excess liquidity (USD, CNY and BTC) to those traders that need it. There is a market for that and users demanding the lowest interest rate will be those that lend.

The interest rate depends on the factors of supply and demand. Indeed, the rate is higher when many users are borrowing (liquidity risk), when users fear that depreciation of the lent asset will occur (currency risk) or when the amount borrowed shrinks because users are withdrawing their funds (exchange risk).

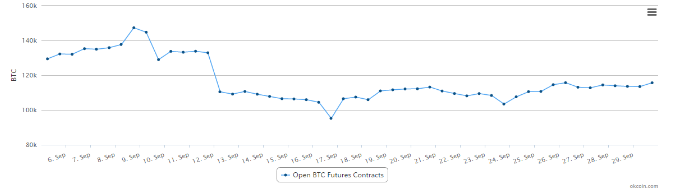

It is worth mentioning that OKC offers other interesting features that will be considered in the second part of this mini-series. In fact, it is the amount of open BTC Futures Contracts.

Sources: BSIC

Sources: BSIC

On the chart below, the distribution of BTC Futures Contracts among the top 5 holders can be seen. However, the chart does not show whether the holder is long or short the contract or the price at which the contract was opened, and that is one of the topics we will research in the next article.

Moreover, next week we will see how to combine these statistics to better understand what happened last month to those investors with big spending capacity, we will see how they interacted between themselves and how they supposedly rigged the exchange rate to squeeze “small players” out of their position.

[edmc id= 4091]Download as PDF[/edmc]

0 Comments