There’s Nothing Smart about Smart Beta

Smart Beta is anything but new: strategies developed in the 70s with the aim of outperforming the market through relatively simple quantitative analysis. It is the middle ground between passive and active investment. Due to the fact that when it comes to stock picking the guidelines are quite simple, commission fees tend to be low. This is the reason for the growth in the popularity of Smart Beta as it now represents about 20% of the $2 trillion market for ETFs.

There are 5 main investment strategies that pick stocks which are (with respect to the benchmark):

- With the lowest volatility

- With the highest positive momentum

- With smallest market capitalization

- Which pay the highest dividends

- With the highest fundamental value (i.e. “cheapest”)

If you have ever taken an economics course you start to realize that everything said until know contrasts with the basic fundamental assumptions of market efficiency. No such strategy should be capable of delivering superior returns, but then in reality it does. In this article, we will look at the strategy that works and try to analyze the drivers of its above-market returns.

Low-Vol is the New Hot

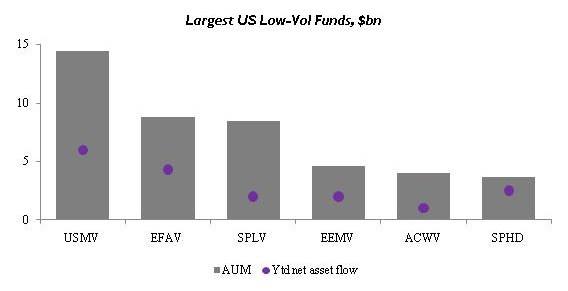

Among smart beta strategies, low volatility factor has been particularly popular this year. Around $44 billion of assets globally are allocated into low-vol ETFs, with over $10 billion being injected since the beginning of this year.

Source: BSIC

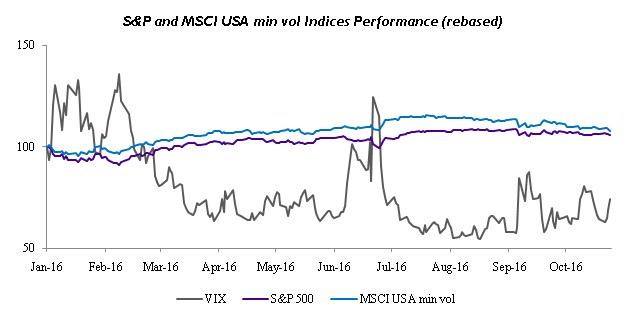

Low-vol funds are particularly attractive for the investors as they are good hedge against market downturns. For instance, during the 2008 crisis S&P 500 fell by 37%, while MSCI minimum volatility index fell by 16.7%. There is also evidence that in the long-term minimum volatility stocks perform better than the market, which contradicts common belief that higher risk should be rewarded with higher return. The academic research suggests that this occurs due to high dividend yield – the only explanatory variable that turned out to be significant – as they are usually quality stocks as well.

Source: BSIC

MSCI minimum volatility index USA, which is tracked by many min-vol ETFs, including Blackrock’s $14bn USMV, is primarily composed of healthcare, consumer staples, information technology and utilities stocks. Top-7 constituents are Procter & Gamble, AT&T, Johnson & Johnson, Paychex, PepsiCo, Verizon Communications and General Mills, which together account for more than 10% of the index.

Why have these funds become so popular particularly this year? The possible explanation is that investors anticipate interest rate increase by Fed and consequent volatility spike, therefore, they want to protect themselves against market movements.

Is Now the Right Time to Invest?

However, some have concerns that the strategy is overcrowded. Investors pulled billions to low-vol stocks, their valuation rose substantially, and those stocks are no more in the lowest volatility quintile. To keep the fees low, asset managers do not rebalance those ETFs frequently enough to reflect these changes in the portfolio. For instance, Blackrock rebalances its USMV fund twice a year, and allows as much as 5% deviation from its benchmark composition. Therefore, some suspect low volatility funds are overheated. Moreover, price-to-book ratio of the min-vol index is 3.34, while S&P’s price-to-book is 2.87. Another alarming signal is that MSCI min-vol index trades at 11.4% premium to market’s price-to-earnings ratio, 1.3 standard deviations from its historical mean. So, there is still some potential for low-vol stocks valuations to grow in the short-term as they are not on their peaks, but in the longer term they are expected to converge to means.

Some of the low-vol funds underlying industries have also shown signs of overheating. This is especially relevant for utilities industry, where valuations have been steadily growing since the beginning of the year without any fundamental reason for it.

Conclusion

Though low-vol stocks perform better during the turmoil than the market, investors have to remember that in any case these are stocks, and their volatility is still high in comparison to other asset classes. It is even higher than the volatility of junk bonds (8.84% vs 6.01% over 3-year horizon). Investors have developed a particular taste for low-vol funds in the first half of the year. However, as time passed, the strategy has shown the signs of being overcrowded. Indeed, low-vol stocks are still traded at premium to market. Despite this, since September their performance has weakened and started to converge to the market returns.

[edmc id= 4226]Download as PDF[/edmc]

0 Comments