Dr Pepper Snapple Group (NYSE:DPS) – market cap as of 17/02/2018: $28.78bn

Introduction

On January 29, 2018, Keurig Green Mountain, the coffee group owned by JAB Holding, announced the acquisition of soda maker Dr Pepper Snapple Group. Under the terms of the reverse takeover, Keurig will pay $103.75 per share in a special cash dividend to Dr Pepper shareholders, who will also retain 13 percent of the combined company. The deal will pay $18.7bn in cash to shareholders in total and create a massive beverage distribution network in the U.S.

About Dr Pepper Snapple Group

Incorporated in 2007 and headquartered in Plano (Texas), Dr Pepper Snapple Group, Inc. manufactures and distributes non-alcoholic beverages in the United States, Mexico and the Caribbean, and Canada. The company operates through three segments: Beverage Concentrates, Packaged Beverages, and Latin America Beverages. It offers flavored carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs), including ready-to-drink teas, juices, juice drinks, mineral and coconut water, and mixers, as well as manufactures and sells Mott’s apple sauces. The company sells its flavored CSD products primarily under the Dr Pepper, Canada Dry, Peñafiel, Squirt, 7UP, Crush, A&W, Sunkist soda, Schweppes, RC Cola, Big Red, Vernors, Venom, IBC, Diet Rite, and Sun Drop; and NCB products primarily under the Snapple, Hawaiian Punch, Mott’s, FIJI, Clamato, Bai, Yoo-Hoo, Deja Blue, ReaLemon, AriZona tea, Vita Coco, BODYARMOR, Mr & Mrs T mixers, Nantucket Nectars, Garden Cocktail, Mistic, and Rose’s brand names. It serves bottlers and distributors as well as retailers.

About Keurig Green Mountain

Founded in 1981 as a coffee roaster and headquartered in Vermont (USA), Keurig Green Mountain, Inc. is a personal beverage system company. Formerly known as Green Mountain Coffee Roasters, the Company acquired full ownership of the brewing systems manufacturer Keurig in 2006 and, in 2014, changed its name to Keurig Green Mountain to reflect the coffee makers retail business it had acquired.

The firm produces specialty coffee, coffeemakers, teas and other beverages in the United States and Canada via two main segments – domestic and Canada. The domestic segment produces and sells coffee and other hot beverages, as well as it also includes immaterial operations aimed at expansion in the US. The Canadian segment likewise sells brewers, coffee and other beverages. The company sources, produces and ultimately sells coffee and other beverages under several brands; additionally, coffee in traditional packaging is sold to retailers (e.g. supermarkets, restaurants, e-commerce etc.).

The Company had got listed on the NASDAQ in 1993 and was delisted in 2015, when it was taken over by JAB Holding Company though its holding Acorn Holdings B.V.

Industry Overview

The deal can be identified as an unexpected move towards another more sluggish sub-sector.

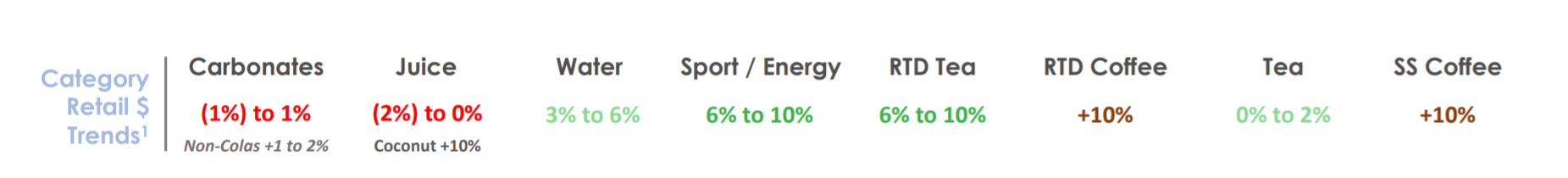

With changes in the masses’ lifestyle and social habits, soft drinks producers in this mature market find themselves under pressure to adapt to consumers’ preferences shift from beverages containing sugar and artificial ingredients to healthier choices including juice, bottled-water and tea. Sport and energy drinks have also seen a steady increase. While coffee remains a fast-growing business in the market, the fizzy segmentation has suffered from a stronger preference towards low-sugar and low-calories drinks, to which Dr Pepper had already reacted through the acquisition of Bai.  Source: McKinsey Retail Dollar Estimates for 2011 to 2016, based on Beverage Digest, Nielsen and Euromonitor; US + Canada; excludes non-packaged formats

Source: McKinsey Retail Dollar Estimates for 2011 to 2016, based on Beverage Digest, Nielsen and Euromonitor; US + Canada; excludes non-packaged formats

Noticeably, coconut has distinguished itself in the past five years among juices. Vita Coco, a Dr Pepper brand emphasizing its hydration and non-concentrate manufacturing process, became the world’s largest and expects to approach $1bn in sales in 2017. Coca-Cola previously purchased Vita Coco’s rival Zico in the year of 2013.

Producers also look for plant-based ingredients to tap into the trend of natural and healthy demand. Furthermore, as suggested by GlobalData, consumers tend to experiment new flavor or flavor-infusion products, which explains the continuous tentative introduction of new flavors into the beverage market (e.g. the salty or even spicy drinks have gained significant attention and interest over the past years).

By combining hot coffee drinks with a range of cold products in the new company, JAB is convinced to introduce a further change in the consumer beverage industry: from manufacturer-defined segmentation to consumer-need focus. The further challenge facing Food & Beverage conglomerates such as JAB and Nestlé nowadays is imposed by smaller companies providing healthy and fine choices.

In terms of M&A activity, one recent and influential development in the Food & Beverage sector was the $100bn AB InBev-SABMiller deal in 2016, signaling developing concentration in the industry. Such a trend, in an industry where resources are scarce and margins get thinner, is mostly driven by economies of scale. Besides high-value mergers, market concentrations are being experienced industry-wide and all across the globe. Besides economies of scale, other drivers can be traced back into cost-reduction attempts, as well as in the acquisition of technological know-how.

Deal Structure

The largest-ever takeover in the soft drinks industry values Dr Pepper’s 180.5m shares at $18,7bn. Dr Pepper Snapple shareholders will receive a special cash dividend of $103.75 per share, implying a 13 percent premium over the average stock price of the past three months in light of the reversing of the target’s listing.

Keurig’s owner JAB Holding Company, the global investment vehicle, together with its partners, will contribute a cash position of $9bn equity investment. An outside investor (BDT Capital Partners) will invest alongside with JAB Holdings. The remaining debt-financing commitments will be provided by JPMorgan Chase, Bank of America Merrill Lynch and Goldman Sachs.

The transaction, having received unanimous agreement of the boards, is expected to close in the second calendar quarter of 2018, by which time Dr Pepper shareholders will keep 13 percent of the combined company Keurig Dr Pepper (KDP). According to the press release, KDP, after combination of Dr Pepper and Keurig Green Mountain coffee business, is expected to realize $11bn annual revenues with strong cash flows and accelerated deleveraging, with target net debt-to-EBITDA below 3.0x and synergies of $600m per year by 2021 to be achieved through cost cuts in sourcing, distribution and administration.

Deal Rationale

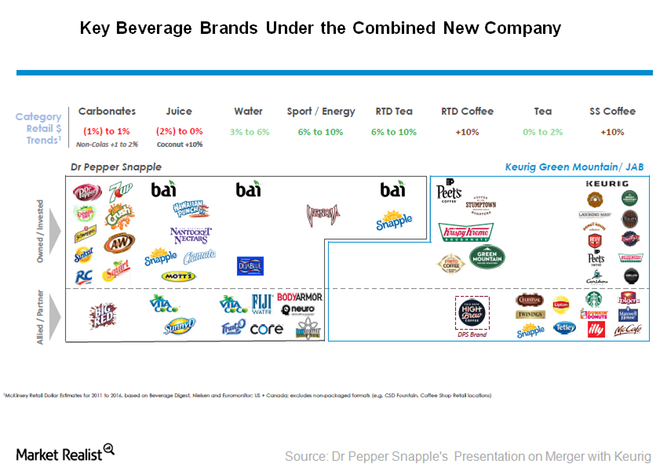

The main advantage of the transaction is the creation of a comprehensive distribution network across the entire beverage industry.

Source: Merger presentation

Keurig Green Mountain currently ranks as the fourth-largest coffee seller (7.4% market share) in the United States and maintains vital relationships with numerous e-commerce platforms. Meanwhile, Dr Pepper Snapple is the third-largest soft-drink maker (8.5% market share) and holds connections to traditional convenience and drugstores as well as beverage vendors. Analysts anticipate that the refined distribution network will allow Keurig Dr Pepper to achieve deeper household penetration and increase sales of key products. The combined entity is expected to maintain a portfolio of 125 brands. Dr Pepper Snapple’s Chief Executive Officer, Larry Young, stated: “KDP will be a total beverage solution that provides options across all consumer needs and occasions, whether they are at work, at play or on the go. The combined organization will unlock opportunities for growth across the entire beverage space”.

Furthermore, the merger is expected to generate $600m in cost synergies, in addition to profitability advantages, including a reduction in headcount and severe procurement benefits. Keurig Dr Pepper will also be able to conquer new business segments, such as the sale of bottled coffee in vending machines. Although the newly established company will hold a total debt of $16.6bn at the time of deal completion, management wishes to reduce the net debt-to-EBITDA ratio to 3.0x within roughly three years.

Despite the aforementioned opportunities, there are concerns about forecasted synergies, the increase in market dominance and logistical benefits: Dr Pepper Snapple’s products are indeed predominately distributed through Coca-Cola’s and PepsiCo’s bottling and sales systems, which could clash with Keurig Green Mountain’s existing distribution model. Additionally, the established entity will be minor in proportion to PepsiCo and Coca-Cola, which continue to dominate the beverage industry. Keurig Green Mountain’s operational structure and segments have in previous years been perceived as unclear, but since the involvement of JAB Holding Company, the firm was able to streamline its businesses and improve fundamentals.

Market Reaction

Following the announcement, Dr Pepper Snapple’s share price increased as much as 32 percent to $126.65. Keurig Green Mountain is a privately-held company and thus was not affected by the declaration. Deutsche Bank downgraded the stock from “buy” to “hold” but raised the price target to $123. Wells Fargo also downgraded Dr Pepper Snapple from “outperform” to “market perform” and elevated the price target to $124.

Advisors

Keurig Green Mountain is being advised by Goldman Sachs, BDT & Co, AFW LP, J.P. Morgan and Bank of America Merrill Lynch. Financial advisory to Dr Pepper Snapple is being provided by Credit Suisse.

0 Comments