Peloton Interactive Inc. [NASDAQ: PTON] – Market Cap as of 12/10/2019 $6.26bn

Introduction

On September 26th, 2019, Peloton, an American exercise equipment and media company, went public on the Nasdaq raising $1.16bn via its IPO. The company raised this capital through floating 40 million new shares at $29, effectively giving the company a valuation of $7.7bn. The IPO raises questions regarding market appetite for loss making companies with not much prospect for future earnings growth, especially considering the slew of highly anticipated yet failed IPOs in recent months including those of Uber and Lyft to name a few.

About Peloton

Peloton is an American exercise equipment and media company founded in 2012 by Graham Stanton, Hisao Kushi, John Foley, Tom Cortese and Yony Feng. The company is headquartered in New York City and its main product is luxury stationary bicycles which allow users to access digital classes through the company’s fitness studios, pre-recorded classes which are streamed on a screen attached to the bicycles. Peloton is the largest interactive fitness platform in the world with a subscription base of over 1.4 million members including bikes, treadmills and Peloton Digital with over 400 employees.

The company focuses on the sale of stationary bicycles and treadmills. These exercise vehicles will then have an interactive touchscreen mounted in order to stream classes though Peloton Digital, classes that are supported both on android and IOS. The company records these classes in two studios in London and New York and is also present at 37 retail locations. Much of Peloton’s services are based on customer loyalty, a trait which is valued by both the company itself and some shareholders. The company had attracted nearly 11,000 new customers a month following the release of their first bike in 2015 and has boomed to over 500m subscribers in 2019, nearly doubling the base since 2018 and quintupling it from 100m in 2017.

Nearly all of Peloton’s revenue (close to 95%) stems from its connected fitness products and its subscription-based services, the former of which makes up the more than 75% of these revenues. The company has seen a rise in the portion of its income related to subscription services, yet is has also been involved in a $300m lawsuit claiming music copyright infringement which resulted in the removal of some songs and features from its streaming service. Moreover, the fitness market is a fairly elastic one with many alternatives to choose from. Adding these facts to the high marketing costs faced by Peloton, it is clear to see why the company is still at a loss; even as revenues have doubled to $915m since 2018, the company’s losses have quadrupled to $196m in 2019. The losses might also be attributed to a sharp increase in the company’s sales and marketing costs. The number increased more than twofold from $151.4m in 2018 to $324m in 2019 and has roughly quadrupled since 2017. In a very segmented market where product differentiation is key, the losses created due to these expenses can be understandable as it has been leading to the company’s growth.

Peloton’s Business Model

Peloton tries to differentiate itself from rivals by attempting to be not only a sports but also a media company. The company produces pre-recorded content in its studios in London and New York and makes about an average of 950 new videos available to customers every month. These videos can be streamed either on screens mounted to Peloton’s flagship bikes and treadmills or even remotely on phones and is meant to be an alternative to gym classes. The company’s value proposition is concentrated on work from home exercise equipment paired with a subscription-based video training program and can effectively be broken down into three product groups. The prices and information referenced pertains to the date this article was written on:

The Bikes: Peloton offers its stationary bicycles from a base price from $2,245 and raises prices to a maximum of $2,694 for a family edition with some add-ons. These models include a 22” touchscreen on which training videos may be streamed. As the Peloton Digital is a separate product group, online classes need to be purchased separately from the bicycles. Thus, customers are faced with an initial outlay for the equipment followed by a subscription fee in order to gain access to the pre-recorded workout programs.

The Treadmills: Peloton also provide customers with treadmills in a similar fashion as stationary bicycles. The product range encompasses a base model selling for $4,295 with a top-of-the-range family model including add-ons priced at $4,844. As with the bicycle, the treadmills come with a screen capable of streaming classes with a separate subscription fee.

Peloton Digital: Peloton Digital is Peloton’s subscription-based video proposition where customers can stream pre-recorded excise videos both on the bikes and treadmills but also for sports such a yoga, running and weight exercises. There are effectively two options to choose from within this product group: one is the Digital Membership available without any equipment for general fitness costing $14.49 per month and the second option which requires you to own a bike or a treadmill is called the Peloton Membership. He latter is customized to the exercise equipment and provides information such as workout metrics, live leader boards and a performance dashboard, costing customers $39 a month.

IPO Structure

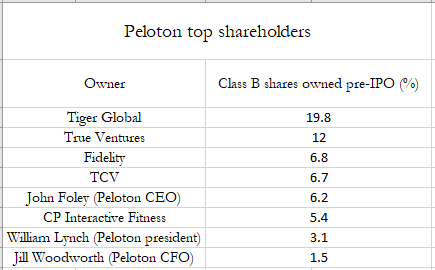

In its initial public offering Peloton offered 40m new shares of class A common stock, each valued at $29, the high end of the range $26-$29, and each carrying a single vote per share. The offering valued the company at $8.06bn and allowed the company to raise as much as $1.16bn. The company has also supervoting class B common shares, which carry 20 votes apiece, giving the founder, Mr Foley, and early backers control of Peloton. This would allow the holders of those shares to control the company with as little as 5% of combined economics stake in the company. Peloton 20-vote-per-share arrangement for insiders is unusual, usually it’s 10 for dual-class tech stock structure, but not unprecedented. In fact, also Lyft and Pinterest gave certain insiders 20 votes per share, and WeWork planned to do that too. Peloton didn’t disclose how many shares its existing shareholders and early VC investors planned to sell in its IPO. However, it is probable, given the track record of past Unicorn IPOs, that the CEO is to become more relevant between the largest class B shareholders and exercise more control after the VC cash out.

The dual-class approach has received lots of criticism and has been accused of being one of the reasons why this year investors have grown wary of Unicorns. In an attempt to partially (though rather ineffectively) offset this negative perception Peloton has adopted a so-called sunset provision which dictates that 10 years after the IPO is completed, the class B shares would automatically convert into Class A common stock. Alternatively, a vote in favour of the conversion by more than two-thirds of the class B shareholders is required, however, this possibility is rather remote. The lead underwriters of the IPO, Goldman Sachs and J.P. Morgan also retained the option to acquire additional 6m shares at the offer price within 30 days after the listing. This option would allow Peloton to raise between $156m and $174m in additional capital, but seen the performance in the following days, this Green-shoe option is unlikely to be exercised.

Deal Rationale

According to the company prospectus the purposes of the offering are to increase the capitalization and financial flexibility of the company and to create a public market for the company’s shares. The net proceeds will be used for working capital and other general corporate purposes, including research and development and marketing activities, general and administrative expense and capex. A portion of the capital raised could also be used for acquisitions.

The IPO comes at a time when the high valuations of US stocks have attracted several listings, as executives at some private companies seek to finalize their offering in order to exploit the lofty valuations. In addition, as the fitness market is extremely crowded and competitive, the listing may be viewed as a way to increase the company’s brand awareness without having to further increase marketing expenses. For the lossmaking company the IPO would also allow to beef up its liquidity with some fresh cash, an important resource for a company whose losses have increase almost four-fold last year to $196m. The company, which before the IPO has historically relied on private capital to sustain its growth, does not expect to be profitable until 2023. Peloton is sacrificing profitability in pursuit of growth, the problem is that its business is getting less efficient as it grows, indicating a lack of a scalable business model: gross profit margin are falling, from 44% in 2018 to 42% in 2019, and its fixed cost as a share of revenues are rising faster, from 54% in 2018 to 64% this year. As a result, raising equity seems the right option to create a cushion for future losses and allow the venture capital to cash out from their early investments, substituting them with public market investors. The problem is that the market sentiment towards loss making unicorns has changed and there is less appetite for risky bets, it is no surprise, then, that the reaction to those numbers wasn’t the most optimistic.

Market Reaction

The debut of Peloton on the secondary market was everything except successful: in fact the stock was the third worst performer in the first day of trade among the IPOs of companies valued more than $1bn. Problems started to arise in mid-morning of the IPO day when on the Nasdaq the stock had not yet started trading due to the lack of investor’s demand. Just at 11.57 am the stock started trading at a price of $27, $2 below the IPO price. But the drop didn’t stop there and the stock traded as low as $24.75, a drop of 14.7%, before closing at $25.76, down of 11.2% thus wiping $925m from the company’s equity valuation and causing a $130m paper loss for those investors who had bought it at the listing price.

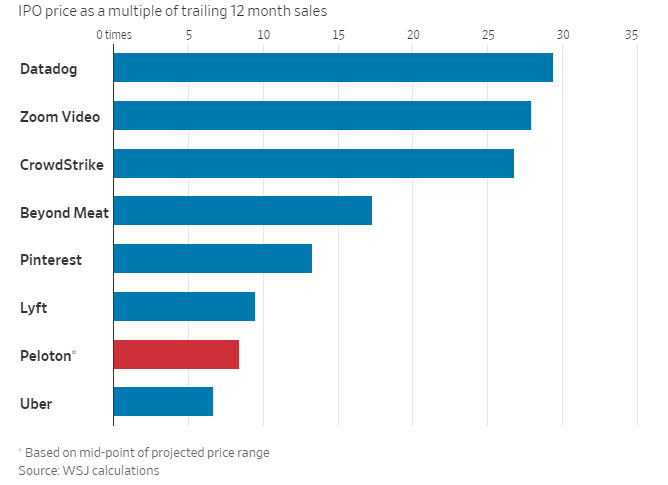

In contrast with the reality, initially the offering seemed in a certain sense reasonable: in the high end of its price range ($29 per share) Peloton’s valuation was little under 9x trailing sales, making it a fraction of the listing value commanded by this year’s hottest IPOs. However, if you compare it with its competitors you will see that is still too high, motivating so the drop: Technogym, which offers fitness equipment is currently trading at 3.1x trailing sales, while The Gym Group, operating health and fitness facilities in the UK, has a price to sales ratio of 2.51x.

Underwriters

Goldman Sachs and J.P. Morgan acted as lead underwriters, while Fenwick & West LLP acted as legal Advisors.

0 Comments