In this article, we will develop an investment strategy on currency, specifically on the USD/CHF pair.

We will:

- Introduce the currency carry trade (for those familiar with it, you are welcomed to skip this brief explanation)

- Review the developments in the Switzerland economy, and move to the current environment

- Develop the investment idea

Introduction to Currency Carry Trade

The simplest currency trade an investor can perform is the carry trade: it involves borrowing an amount of money in a currency with low interest rates, convert them into a currency with high interest rates, invest in this currency at risk-free, and at maturity convert back the capital into the original currency to settle the debt (by paying the low interest rate for the borrowing).

The strategy exploits the interest rate differential between two countries, with the risk of the exchange rate moving against the investor. In the carry trade, investors disregard credit risk because they invest in risk-free assets, ex. US treasuries (with the note that even treasuries hold a tiny risk if not held until maturity).

To illustrate this simple strategy, imagine we decide to bet on the USD and CHF interest rate differential. The currency pair USD/CHF is currently at around 0.97, i.e. 0.97 CHF for 1 USD. Imagine a 1y trade on 100 CHF, we would perform:

- Borrow 100 CHF at -0.52%

- Convert 100 CHF into 102.68 USD at current rate of USD/CHF = 0.97

- Invest 102.68 USD at risk-free rate of 2.111%

Wait 1y and close the transaction:

- Obtain 105.51 USD from the risk-free investment

- Convert 105.51 USD into 102.76 CHF at USD/CHF = 0.97

- Settle the debt, accounting for the interest owed of: 99.48 CHF

The final profit in this example would be 3.28 CHF or 3.36 USD.

Please notice that the main risk bore in this investment is the foreign exchange rate. In the example we assumed USD/CHF to remain constant at 0.97 for an entire year, something very unreasonable. Even though G10 FX volatility has been historically lower than equity volatility, it is presumption that FXs are going to stay flat. Conversely, interest rate differentials do not represent a risk: they are fully known at initiation of the trade. Therefore, this strategy is effectively a bet on the exchange rate.

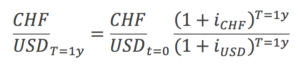

In practice, to perform such a trade there would be no reason to replicate all the steps above since exists a derivative that does exactly this: it is the well-known forward derivative. This common derivative’s no-arbitrage condition is exactly the carry trade, i.e. borrow, convert, lend, receive, convert back and close. Under annual compounding

In the example above, by no-arbitrage condition the USD/CHF 1y forward contract is 0.9428. By performing the carry trade above, we would obtain 105.51 USD which converted into CHF gives us 99.48, exactly the amount due for the borrowing.

The simple takeaway is that the carry trade is equivalent to entering an FX forward position, e.g. long FX forward at 0.9428 at 105.51USD notional is equivalent to carry trade at 100 CHF (or 102.68 USD, converted at spot rate of 0.9739).

Recent Developments in the Swiss Franc

Let’s start by looking at the historical evolution of the EUR/CHF currency pair, i.e. how many CHF for 1 EUR. During the Financial Crisis and the subsequent Euro Sovereign Debt Crisis, many investors were rushing to the Swiss Franc as a storage of wealth as they were concerned about the environment of the global economy. This drove the Franc to drastically appreciate against major currencies, bringing concerns of reduced net trade balance. In addition, the Swiss National Bank (SNB) was concerned about the impact of rising cheap imports, i.e. deflation, and in 2011 opted for a peg EUR/CHF = 1.20.

Later, in January 2015, the SNB decided to drop the peg mainly because it had printed too many Francs to maintain the peg that in the future it would lead to hyperinflation. This led to an immediate appreciation of 41%.

Over the last 3 years, the Franc has depreciated steadily driven by optimism over the economy, for example in April 2017 just after the French presidential elections, concerns over political instability in the Eurozone faded; which drove the Euro to appreciate from 1.07 to 1.09.

Currently, the pair has reached the key level of 1.20. What will happen from now on?

Moving Forward

Generally, the position of the SNB has not changed over the years: they desire a weak currency to boost exports and raise inflation. Unfortunately, the central bank has been unsuccessful in reaching its target of 2% for almost a decade, as seen in the chart below.

Thus, the SNB has been desperately trying to increase inflation by implementing an ultra-loose monetary policy on interest rate of -0.75%. Although, the interesting aspect of such an accommodative monetary policy is the unemployment rate: 2.9%, as a comparison: the US economy holds a 4.1% unemployment rate.

On Thursday, the SNB stated that the Franc is moving in the right direction, and that “it’s not the time today to talk about changing monetary policy. We are convinced that the current monetary policy is still necessary. We still have a relatively fragile situation, it can change from one day to the other”, said President Thomas Jordan. Therefore, it is quite safe to assume that interest rates are not going to rise and the SNB is rooting for a weak Franc.

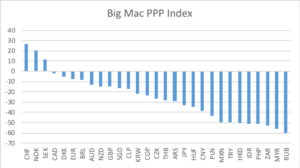

Finally, if we plot the infamous Big Mac PPP index, we can see that the Swiss Franc is the most overvalued currency in the world, followed by the Norwegian Krone and Swedish Krona. The result doesn’t change if we plot a time-series graph: the Swiss Franc has been the most overvalued since 2015, where it fell to 2nd position after the NOK.

Source: Bloomberg

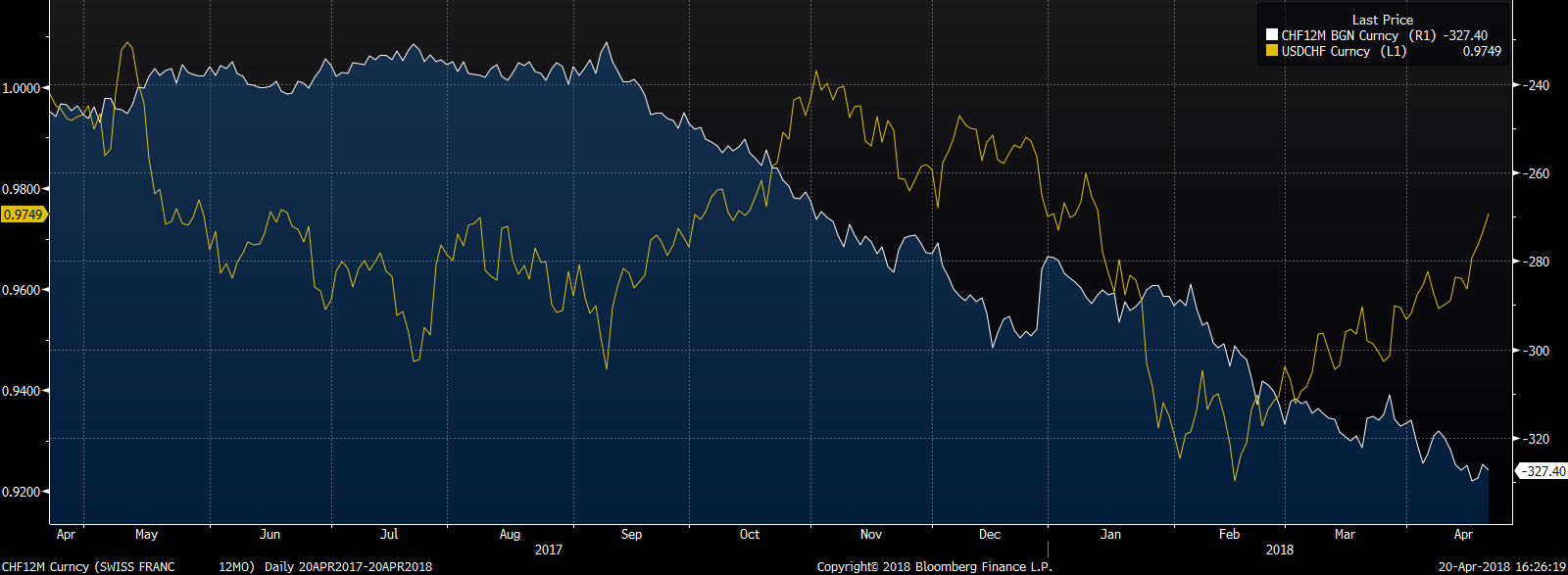

Instead, if we move and look at the past performance of the USD/CHF, it is quite hard to see any trend in the last years. Why? Because in general it wasn’t the weakness of the CHF that drove the pair, but the strength of an improving Eurozone economy. Together with Mr. Draghi hinting at tapering monetary policy.

Currency Carry Trade on USD/CHF

Given the long premise and description of the Switzerland economy, we think a carry trade on the USD/CHF might be worth your attention.

The reasons for shorting CHF are:

- SNB clearly stated it doesn’t have any intention of reducing accommodative monetary policy and roots for a weakening CHF

- Swiss interest rate is extremely low (negative), making the borrowing even cheaper

Instead of betting on the rising of EUR/CHF, we deem more conservative to perform a carry trade on the USD/CHF pair because of the higher interest rate differential: we can see that CHF rates are 327bps lower than US’s.

0 Comments