Monex Group Inc (TYO: 8698) – market cap as of 20/04/2018: ¥149.15bn

Introduction

On April 16, the online brokerage giant Monex officially acquired the cryptocurrency exchange Coincheck for ¥3.6bn (~$33.55m). The move is questioned by the general public due to the recent security breach in Coincheck and the theft of $534m worth of the NEM cryptocurrency. Nevertheless, the deal has several strategic implications and possible rationales.

About Coincheck

Coincheck is a cryptocurrency firm headquartered in Tokyo, Japan. The company was founded by Koichiro Wada and Yusuke Otsuka in August 2014.

The main business of Coincheck is its exchange platform and bitcoin wallet. However, it is also involved in offering crypto payments and lending services.

As of August 2016, the exchange had over $160m worth transactions per month. One of the biggest projects of Coincheck was based on the decision of the entertainment company DMM.com, which has over 19 million users, to start using Coincheck’s bitcoin payment processing solution. Another big project was the partnership with SEKAI to support Chinese, Hong Kong, and Taiwan investors to buy Japanese real estate with bitcoin.

About Monex Group

Monex Group is a Japanese financial services company based in Tokyo, Japan. The Group has a large online brokerage business, as well as an M&A advisory business. The firm’s main competitors include SBI Securities, Rakuten Securities, Matsui Securities and Kabu.com.

“Monex, Inc” was established on April 5, 1999. On April 4, 2000, the company got listed on the Tokyo Stock Exchange “Mothers” Market. In 2004, Monex Beans Holdings, Inc was established by means of a share transfer by Monex, Inc. and Nikko Beans, Inc. and later, in 2008, it changed its name to “Monex Group, Inc.”

Monex Group was one of the pioneers of online brokerage in Japan, starting under the name Monex Securities, and has since then made some big acquisitions, in a way to expand its footprint and global reach. Some of the most important acquisitions made by the Group were those of the first online brokerage company in Asia, BOOM Securities of Hong Kong, and of TradeStation Securities, a U.S. online brokerage company with a specific appeal to active traders. These acquisitions pave the way of Monex to achieving its “Global Vision” strategy by providing it with its three main segments – Japanese, USA, and Asia-Pacific.

Other acquisitions of the Company include those of IBFX Holdings, LLC, and Interbank FX, LLC.

Industry Overview

The growth of cryptocurrencies has been exponential since their creation in 2009, with the total cryptocurrency market capitalization currently standing at over $366bn. While growth has been strong, the market capitalization of cryptocurrencies as a whole is still only a fraction of that of the S&P 500 index, which is itself only a fraction of the global stock market. There is still room for considerable growth but the market immaturity, extreme volatility and further problems make the sector unappealing for the majority of financial experts and institutions.

The blockchain technology has been around for more than 10 years and is highly praised for its potential capabilities in security, decentralization and transparency. Unfortunately as of yet, the only real use case has been cryptocurrencies. Alongside the aforementioned problems, a multitude of scams, thefts and empty promises have been plaguing the cryptocurrency space and have contributed to the bad reputation of the market. Some of the more popular products include utility cryptocurrencies, value cryptocurrencies and initial coin offerings. The first is used as “gas” money to fuel certain operations like executing lines of code (Ethereum) or paying for services. The second type carries value mostly because of the public perception and is mainly used for speculating on the crypto market (Bitcoin, Dogecoin, etc.). Finally, the third product is somewhat similar to a crowdfunding campaign, except each investor receives a certain amount of the company’s proprietary cryptocurrency respective to his donation with the hope that it appreciates in value once the “coin” is officially listed on an exchange.

Deal Structure and Rationale

Coincheck has officially become a wholly-owned subsidiary of Monex Group on April 16, after the leading online securities firm agreed to invest ¥3.6bn (~$33.55m) in the acquisition of the exchange. It has been confirmed by Monex group that, as per the share acquisition agreement signed on April 6, the company will be acquiring 100% of the shares of the exchange, which amounts to about 1.78 million at the cost of ¥3,600m. The shares will be transferred at around the end of this month (April 26).

Coincheck Financials and Corporate Restructuring: Monex disclosed Coincheck’s financials for the fiscal year ending March 31. The exchange’s revenue was ¥980m (~$9.13m) and its net operating income was ¥719m (~ $6.7m). Moreover, the exchange has approximately 1.7 million user accounts and 71 employees. Monex CEO Oki Matsumoto told Coincheck’s employees, as reported by Business Insider Japan, “There are no personnel changes,” adding that Monex will respect the salaries and treatment of Coincheck’s employees and will not “change the company name or logo” and emphasizes continuity. Citing that he believes the Japanese Financial Services Agency (FSA) will grant the new Coincheck registration within two months, he reiterated at the press conference: “We will restart Coincheck business within two months.”

Key Executive Changes: This acquisition will further remodel the board of Coincheck. The business improvement order issued by the FSA mandates both key executives of Coincheck, CEO Koichiro Wada and COO Yusuke Otsuka, to resign from the company’s Board of Directors. Toshiko Katsuya, the senior executive at Monex will become in charge of the cryptocurrency exchange taking the position from Koichiro Wada who will become an executive under the new management.

Considerable Risks: In January, Coincheck was hacked and lost $534m worth of the cryptocurrency NEM, which the exchange has paid out from its own earnings. “The risk of litigation has been discussed with lawyers and it ranges from 1 billion to 2 billion yen [~$18.6m] at the most,” said the CIO of Monex Group adding that the cost will be borne by existing shareholders and the burden of Monex will be limited. In any case, one must consider that things can change in the future with a possible negative impact on Monex Financials.

Expansion of the customer base, entrance into the crypto marketspace and reduction of regulatory burden: A document disclosed in the conference shows that Coincheck grew in the crypto market boom with its sales increasing from ¥123m in 2014 to ¥77.2bn in 2016. The existing user base and the growth of Coincheck will help Monex Group to enter into the crypto market. Japan is already well packed with over 30 crypto exchanges and by acquiring the existing players in the market, traditional financial firms can gain entry into the crypto market far more easily than going through the registration process with FSA. The Coincheck acquisition by Monex Group will affect not only the Japanese market but also the US market as Monex also owns TradeStation, which is a US firm dealing in the online brokerage that got into bitcoin trading this year. It is likely that Monex will use its existing knowhow to compete in the US market.

Market Reaction

Hacking Incident of 2018: On January 26, 2018, $534 million worth of NEM coins were stolen by hackers from Coincheck. The funds belonged to customers of the exchange, which were stored in an online ‘hot’ wallet.

According to Coincheck officials, the reason for the breach was a stolen private key, which allowed the NEM coins to be transferred from the wallet. As this was not a break in the blockchain, it raised concerns over how the coins were stored in the wallets.

Reimbursement announcement, market reaction and supervision by authorities: Japanese authorities have intensified the supervision upon the exchange platforms and have increased the security requirements since the cyberattack day. Japan accounts for about half of the total global volume of operation in bitcoin, the most popular cryptocurrency, and Coincheck alone used to move about ¥2,466bn, as the specialised website Cryptocompare estimates.

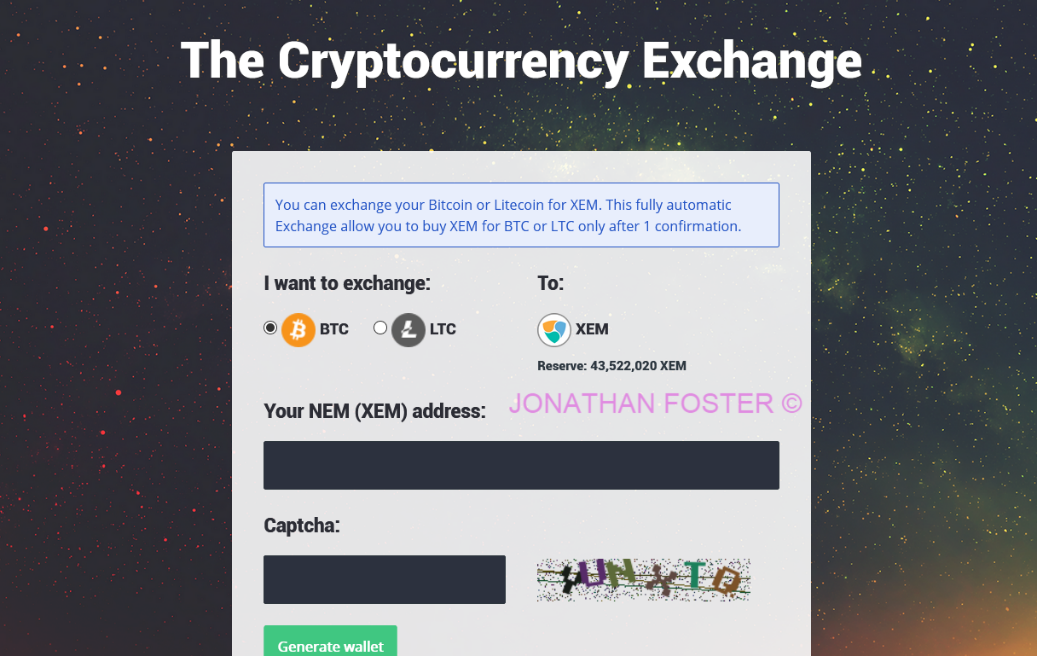

In the hours following the news of the Coincheck hack NEM plummeted c. 20% vis-à-vis BTC with significant volume. The spike prior to the announcement is interesting and could be the exchange itself initiating a “too-early” repurchase of NEM. Less than 48 hours after the release the following website on the dark-web was offering blocks of NEM for a very high discount (up to 20%).

It was possible to purchase only by using bitcoin (BTC) and Litecoin (LTC). It is plausible that the hacker put up this scheme in order to obfuscate his transactions and hide the stolen funds. NEM does not offer the same privacy features available in other cryptocurrencies, thus a smart way to hide this huge amount of NEM was to simply break it up into thousands and thousands of smaller blocks belonging to different users and exchanging it for BTC which enjoys a higher degree of anonymity. Note however that all transactions can still be found on the BTC blockchain, but the recovery is now much more complex – if not impossible – as liabilities are spread among different cryptocurrencies and several users.

The NEM Foundation declined to conduct a hard fork to roll-back the transaction as they push the fault on Coincheck and not on NEM technology. It is however a strongly negative indicator that there exists an entity such as a “foundation” able to determine whether there is ground to conduct a hard fork: this is the opposite of decentralization. Nevertheless, the NEM foundation developed a software to taint and track stolen funds such that exchangers could intervene in case they found one of their users depositing stolen funds on their trading platform, however this software is opt-in and cannot be forced on other users which are still free to transact stolen funds. In an announcement on the 18th of March, the NEM foundation disabled the tracking system it had previously developed. No further details were released from it and it is unclear whether it was useful in any case.

NEM is down -50% versus BTC since the announcement of the hack and down -70% versus USD.

0 Comments