Restaurant Brands International Inc. (NYSE: QSR) – market cap as of 24/02/2017: $25.666bn

Popeyes Louisiana Kitchen Inc. (NASDAQ: PLKI) – market cap as of 24/02/2017: $1.638bn

Introduction

On February 21, 2017, the multinational fast food company Restaurant Brands International (RBI) – parent company of Burger King – announced that it entered into an agreement to buy Popeyes Louisiana Kitchen (Popeyes) in a transaction valued at c. $1.80bn. The offer of $79.00 per Popeyes share implies a 19% premium to the closing price on the day before the announcement.

According to the firm’s press release, the deal will be financed with cash reserves and a loan from J.P. Morgan and Wells Fargo. The acquisition will allow Popeyes Louisiana Kitchen to take advantage of Restaurant Brands’ global footprint, competencies and large customer base. The transaction is expected to close by April 2017.

About Restaurant Brands International

Restaurant Brands International (RBI) was initially established through a $12.5bn merger between the American restaurant chain Burger King and the coffee shop and restaurant chain Tim Hortons in 2014. The “quick service” company operates in roughly 100 countries and owns c. 19.000 restaurants across the globe. According to the firm’s website, 11 million guests visit Burger King each day.

Although Restaurant Brands is listed on a stock exchange, 51% of the company is controlled by the multibillion-dollar investment company 3G Capital. Berkshire Hathaway also maintains a 4.8% stake in the firm.

RBI recently announced the establishment of a master franchise joint venture, in order to expand the Tim Hortons brand in Mexico, England, Scotland and Wales.

In FY2016, the firm reported total revenues of $4.15bn, which represents a 2.3% increase compared to the previous year. In 2016, RBI announced net income of $616m, compared to $375m in 2015. The company’s EBITDA also increased from $1.33bn in 2015 to $1.84bn in 2016. Lastly, Restaurant Brands has expressed the intention to repurchase approximately $300m worth of common shares over the next 5 years.

About Popeyes Louisiana Kitchen

Popeyes Louisiana Kitchen (Popeyes) was founded in New Orleans in 1972, but is nowadays headquartered in Atlanta. With 2.500 restaurants in more than 40 American states and in 30 countries globally, the firm is the second-largest quick-service chicken restaurant group in the world. While 90% of the restaurants are located in Louisiana and Tennessee, 55% of the international franchises can be found in South Korea, Canada and Turkey.

In 2005, the firm made considerable changes to their governance structure and business model, closing several offices and laying-off staff members.

Popeyes operates via a franchise system with allows the company to generate steady cash flows and to reduce its operating risk. In FY2016, Popeyes Louisiana Kitchen reported total revenues of $269m, a 3.9% increase compared to the $259m figure in the earlier year. The company reported net income of $43m in 2016, slightly lower than in 2015 ($44m). On the other hand, the company’s EBITDA increased from $83m in 2015 to $85m in 2016.

Deal Structure

According to the terms of the agreement, Restaurant Brand International will offer $79.00 per share to Popeyes shareholders, in an all cash transaction. The offer implies a 19% premium to the closing price closing price on the day before the announcement.

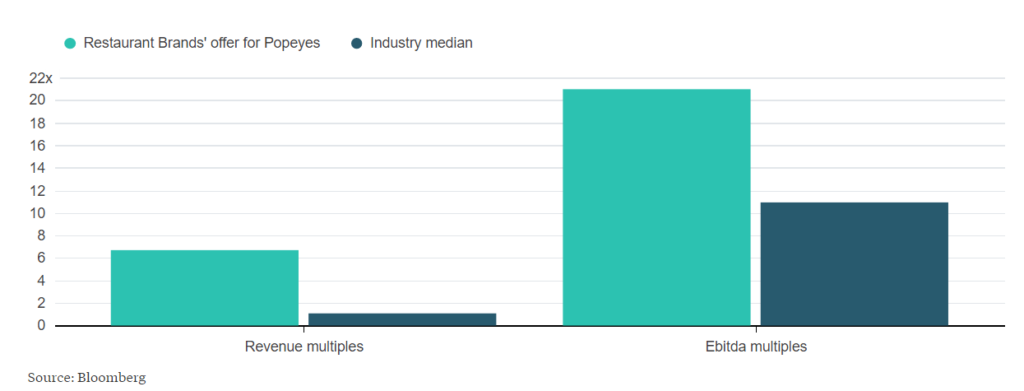

The $1.8bn acquisition implies high multiples, both in terms of EBITDA (EV/EBITDA of 21x) and revenues as Popeyes will be acquired at more than 6x last year’s revenue – the highest sales multiple in the history of American restaurant companies’ takeovers.

Source: Bloomberg, BSIC

The multiples above may suggest that RBI bears a significant risk of overpaying its target. Nonetheless, the price seems to be justified by Popeyes’ remarkable international growth potential as well as its recent operating performance in terms of revenue growth rate and margins. Indeed, Popeyes’ EBITDA margin (c. 32%) is above the industry average, and can be considered acceptable given that fast-food companies face constantly increasing competition and have a relatively low pricing power.

Last but not least, the backing of 3G Capital is an excellent guarantee of success for Popeyes (and for the combined company), as the private equity firm is famous for enhancing (usually via cost cutting) the performance of the companies in which it invests.

RBI will finance the transaction through its available cash and a financing commitment by J.P. Morgan and Wells Fargo. Indeed, this financing structure seems very appropriate for Popeyes, one of the most under-leveraged companies of the industry, which is currently working to move its capital structure towards a higher level of debt (targeting a leverage ratio of 3.5 by the end of 2017, almost doubling last year’s ratio).

The transaction is subject to regulatory approvals and it’s structured as a tender offer to Popeyes shareholders with the aim of total control. All not-tendered shares will be acquired by RBI at the same price through a second step merger. The transaction is expected to close April 2017.

Deal Rationale

One of the main reasons encouraging Restaurant Brands to pursue this acquisition is the prospect of fueling its growth in North America first, and globally short after. Synergies will not be missing as well: Restaurant Brands will likely be able to employ its scale and resources to help Popeyes achieve a more global position.

RBI will focus on seizing as much as possible of the still underdeveloped growth potential of Popeyes. Indeed, Popeyes is already a strong brand which has managed to achieve a high degree of loyalty from its customers. This is essential in a competitive environment such as the fast food industry. Therefore, the company owning Burger King and Tim Hortons is confident it will succeed in boosting its target’s growth by opening new restaurants at a faster pace than ever before. This unexploited growth is exactly what makes Popeyes attractive from Restaurant Brands’ perspective. This attractiveness is so compelling that it has allowed to overcome the issue related with the small accretion of earnings that the agreement will generate.

From Popeyes’ point of view, being acquired by RBI is not only a proof of the great performance achieved by its management team, but it will also deliver immediate value to its shareholders given the generous premium offered.

Market Reaction

Speculation about the agreement was firstly confirmed on February 13, 2017. Both RBI and Popeyes’ stock prices immediately reacted positively to the news, surging 4.63% and 7.24% respectively.

At the end of the trading activity of February 21st, the day of the official announcement, Popeyes’ price per share climbed 19.07% to $78.73, while the shares of Restaurant Brands were trading at $57.60, a 6.86% increase with respect to the previous day. The remarkably positive performance suggests that investors have welcomed the agreement.

Advisors

UBS and Genesis Capital LLC are advising Popeyes Louisiana Kitchen Inc., while Restaurant Brands International Inc. is being advised by Paul Weiss Rifkind Wharton & Garrison LLP.

0 Comments