Honda Motor Co Ltd: Market Cap as of 12/10/18 – JPY 5.601tn

General Motors Co: Market Cap as of 12/10/18 – $44.95bn

Introduction

On October 3rd Honda announced a $2.75 billion investment in General Motors Cruise self driving unit, obtaining a 5.7% stake in the company. The transaction was conducted to develop together autonomous vehicles for global deployment in ride services fleets.

About Honda

Established in 1946 in Japan, Honda is one of the several established companies racing towards the advent of self-driving cars.

Honda was originally known as the world’s most famous motorcycle producer. Since its inception, it has branched into automobiles and power products, while also offering financial services to facilitate customers’ purchases. During the FY2018, it sold 28.76m units across its 6 divisions and 3 main product lines. The motorcycle and automobile divisions offer diverse options to fit individual’s different business and personal needs, an aspect that has allowed Honda to maintain its success in those areas. It is highly dependent on its retail dealers to sell motorcycles and automobiles to customers, but maintains a wholesale model for its power products.

During FY2018 Honda experienced moderate financial growth, with revenues rising by 9.7% YOY, from $13.9m to $15.36m. Additionally, it experienced EBITDA growth of 5.08% and net income growth of 71.81%. Honda’s valuation, undeterred by falls in the price of its stock within the past year, is $97.4bn. Despite being well known for internal R&D spending, Honda is following the automotive industry trend of “open innovation”, collaborating with larger players like GM to enhance things like EV technology and hydrogen fuel cells. This type of innovation also defines their new investment into GM Cruise LLC and the driverless vehicle industry.

General Motors

Another player looking for a spot on the pedestal of self-driving cars is General Motors, the American multinational corporation pieced together in 2009 from the pillaged remains of one of the American automotive “greats”: General Motors Corporation. Headquartered in Detroit, General Motors Company is dubbed by many American car aficionados as the “new GM” and maintains a similar dominance to that which defined its predecessor. GM currently designs, builds, and sells everything from car parts to fully working vehicles for well-known brands such as Buick, Cadillac, Chevrolet, GMC, Holden, and Vauxhall. During FY2017, ending December 2017, GM experienced a drop in sales of 2.41%, but EBITDA growth of 11.17%.

While its headquarters may be in the car capital of America, one of its most intriguing ventures is far from it – in the desert of Arizona. In early 2016 GM acquired Cruise Automation, a San Francisco based startup leading the way in the development of driverless cars, for $581m. A combination of loose regulatory standards, easier roadways, and superior weather conditions have pushed GM Cruise LLC to test and develop their driverless automotive systems in Arizona. Two years and many undisclosed miles later, the division is flush with money from Softbank’s vision fund and plans to pursue advanced development of a commercially marketable product. Following the $2.25bn investment from Softbank in May, the division was valued at $11.5bn.

Industry overview

Since the global automotive industry’s inception in the 1860’s, consumers have gone from riding glorified carriages with speeds up to 16 km/hour to 2 ton-computers packaged in aluminum and steel. China, which since 2009 has boasted the world’s largest regional automotive market, occupies 30% of global sales with an industry CAGR of 18.1% across the past decade. In comparison, U.S. performance is still good, with an industry value of $620bn and a projected CAGR of 3.6% through 2020. On a broader scale, the global economy produced 98.9 million vehicles and is expected to break the 100 million vehicles mark by 2020 or earlier.

This growth is driven by macroeconomic factors and new technology trends, such as that which gave rise to the growing popularity of electric vehicles. However, for all of the industry’s rapid developments, there has been little change in its competitive landscape. While the OEM sub-segment remains varied, large auto manufacturers such as Ford Motors, Toyota, and Honda have dominated for decades due to economies of scale and high barriers to entry. However some would argue that the newest trend to take the car world by storm, driverless vehicles, will actually create an upset among market leaders.

The driverless vehicle industry began in earnest with the creation of its current industry leader, Waymo, in 2009 by Google’s parent company Alphabet. By 2013, GM, Ford, Mercedes Benz, BMW, and other major car companies began developing their own fully autonomous car technologies. As larger corporations leapt into the fray, the SAE Autonomy Scale was developed to classify the different levels of autonomous vehicles, which ranges from Level 0 (no automation) to Level 5 (full automation with no need for manual controls). The distinctions between Levels 1 through 5 are primarily based on one aspect that has come to define driverless cars’ success: the amount of manual intervention needed to run the vehicle.

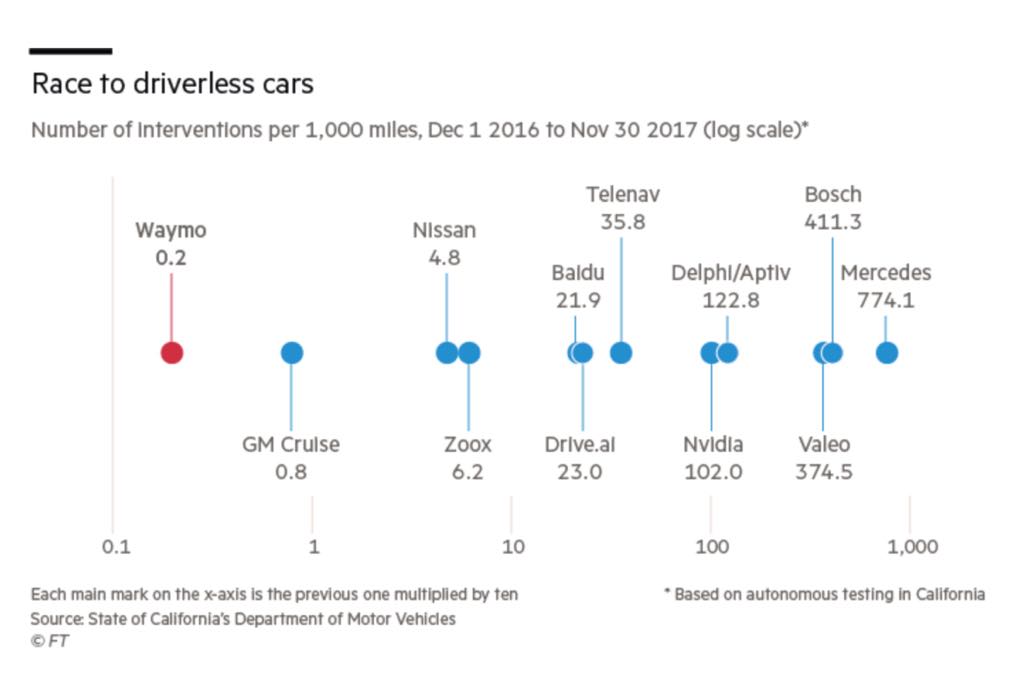

Source: Financial Times

(competitive landscape of the American driverless car industry, based on Number of interventions per 1,000 miles)

As shown by the chart above, industry pioneers Waymo and GM are lapping their competitors in regards to driver interventions. However, they are not the only ones racing to achieve level 4 vehicles within the next decade. While it’s clear Bosch or Mercedes won’t be the industry leaders, it’s understandable why they keep chasing the wheels of Waymo. After all, even those who come in 5th or 6th place usually get some, albeit small, slice of the prize money. Goldman Sachs estimates the robo-taxi and autonomous ride hailing industry to grow from $5 billion in revenue today to $285 billion by 2030. Operating margins of automotive corporations are estimated to grow to 20%, something investors have pointed to as they push valuations of unprofitable startups to unrealistic highs. This intense financial growth, based on an estimated industry CAGR of 36.2%, is driven by industry trends such as the use of AI to enhance autonomous software, expansion into automated commercial vehicles, and enhanced cooperation among developing firms. However, external factors like regulation and consumer faith will be key in determining if driverless vehicles can actually get consumers to “sit back, relax, and enjoy the ride”.

Deal structure

Honda will take a 5.7% stake in Cruise by paying 750 million USD as an equity investment and additionally spend 2 billion USD over the next 12 years. This transaction brings the value of Cruise to 14.6 billion USD, representing about one third of GM’s market capitalisation. GM acquired the start-up in March 2016 for around 1 billion USD of which 581 million were paid in cash and the rest of the price in bonuses to key employees.

Honda is becoming the second outside investor. In May Japan’s SoftBank Group announced an acquisition of 19.6% stake of Cruise, valuing the company at 11.5 billion USD. The Softbank Vision Fund Group invested 2.25 billion USD in Cruise, of which $900m were equity and the remaining will be paid when Cruise’s vehicles will be ready for commercial deployment.

The long-term payment by Honda emphasises the long-term horizon of the partnership between GM and Honda in the project of future self-driving vehicles.

Deal Rationale

Following the $2.25bn investment of Softbank in GM’s former wholly owned subsidiary Cruise Automation, the Honda’s $2.75bn investment further invigorates Cruise’s fighting chance for a lead role in the future autonomous vehicle market. The deal demonstrates that the two companies are reluctant to take on all the risk, expense and engineering resources needed to enter the new market of autonomous vehicles. GM and Honda, which already have a JV to produce hydrogen fuel cell systems by 2020, recently deepened their relationship, this time around electric vehicle batteries. The automakers announced in June 2018 an agreement for Honda to use battery cells and modules from GM in electric vehicles.

The road to achieve an actual autonomous vehicle market is expected to be long and expensive. LMC Automotive, a leading company in automobiles sales and production forecasts, recently said that the firm does not believe that there will be a meaningful number of fully autonomous vehicles in any driving situation before 2030. Hence Honda, who is undeniably behind in the autonomous vehicle race with a basic standard level 2 self-driving system, has decided to share this journey with GM’s more technologically advanced autonomous vehicle automaker Cruise. Indeed, GM and Cruise announced that in 2019, they will roll out the first-mass production vehicles capable of operating autonomously under limited conditions, at standard level 4. With this deal, Honda gains a competitive position in the market whilst Cruise and GM gain engineering expertise as well as capital to enhance its research.

But why signing onto such an expensive journey? Some automakers, such as Fiat Chrysler, have decided to stay aside and wait for technology to be commoditized and offered by mobility service companies; and others, namely General Motors and Honda, have decided to take part in the research arguing that an early presence would secure a major role in the market. Brian Collie, head of Boston Consulting Group’s U.S. automotive practice, recently said “There won’t be a ton of companies doing this, there will be a select few […] Being there first establishes consumer trust. Brand value matters”.

The agreement between Honda and General Motors was highly unexpected considering that back in April Honda and Waymo, GM’s biggest competitor and market leader, were openly negotiating and rumour had it that they were on the verge of signing a deal. Allegedly, Honda was unwilling to sign a deal that would relegate it to being a relatively anonymous hardware provider for a Waymo-branded service. In an interview with Bloomberg, Mike Ramsay of industry advisory firm Gartner described Waymo as “difficult to work with because they want everything”. Furthermore, what may have played a major role in Honda’s change of mind is the fact that Honda and GM share a history of partnering on a number of technologies, such as batteries, powertrains, fuel cells and the fact that Cruiser has actually the capacity to manufacture the vehicles unlike Waymo.

Market reaction

The Detroit automaker’s shares are trading 18.37 % down over this 2018 year. On the news, optimism arose and GM shares surged more than 5 % in the premarket trading but stock finally closed up 2.1 percent at $34.00.

The Japanese’s automaker’s shares are down 16.6 % this 2018 year. In Honda’s case, the deal news was not welcomed by investors and the company ended the trading session 4.25 % lower at JPY 3,338.

Advisors

Advisors of the transaction have not been disclosed, likely because of the small stake acquired.

0 Comments