One more (last) round of QE

After 2008, the European Union has faced some serious problems and particularly troublesome was the financial sector after well-known streak of bankruptcies that plagued the whole world. Given the heterogeneity of European nations, it was difficult to find a unique solution for all of them. In addition, it was clear that EU member states were concerned more about their own interest rather than on the stability of the Union. As an attempt to resolve the situation, the European Central Bank started reducing interest rates, starting from 3.25% in November 2008 to 1% six months later. Between 2010 and 2011, after the downgrade of sovereign debt of Portugal, Italy, Greece and Ireland, investors started dumping bonds and spreads had increased dramatically. Since then, the ECB became much more involved in EU markets with open market operations and programs such as Long Term Refinancing Operations (LTRO) and APP (Asset Purchase Program).

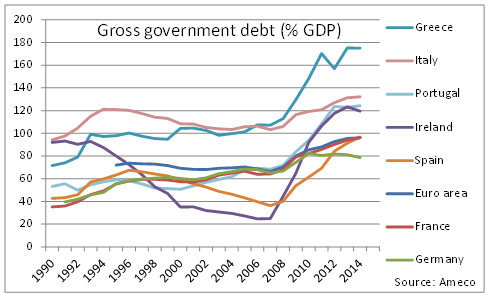

On the 22th of January 2015, Mario Draghi said at the World Economic Forum that at least for one year, ECB would start buying sovereign and corporate bond (CSPP) for 60bn EUR per month. However, it is important to point out that the challenge for the ECB is perhaps more difficult compared to that of FED and BOJ as the EU is composed out of 28 countries with very different fundamentals (both at macro and micro level). After 2008, the debt-to-GDP ratio of most European countries has started increasing again, despite the period of cautious reduction (2000-2008). During 2011, investors – fearing a possible insolvency and a hypothetical debt restructuring – started to sell a widespread array of bonds, and yields of PIIGS obligations reached unsustainable levels. In 2011, the spread between Italian 10-year BTP and German 10-year Bund reached 570 basis point. As a comparison, it should be stated that today’s spread is around 160 basis points.

Source: AMECO

Mario Draghi made it clear: the primary function of QE was to protect European Union and Euro from collapsing (see the famous speech “[..] Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough”.)

The intention was to find a way to temporarily stimulate economy and give national states some breath to make the so called necessary “reforms” needed to protect European Union from its underlying fragility. So far today – in 2017 – those reforms are yet to be implemented. As Draghi’s says: “reforms in the job market must go side-by-side with reforms of the production system, such that the mechanism of price transmission is more effective”.

Today Draghi is facing the following choice:

A) Keep on with the QE, keep on buying debt and keep interest rates low enough such that EU28 countries have more time to solve their structural problem;

B) Start the tapering and reduce the amount of purchases so not to distort markets longer.

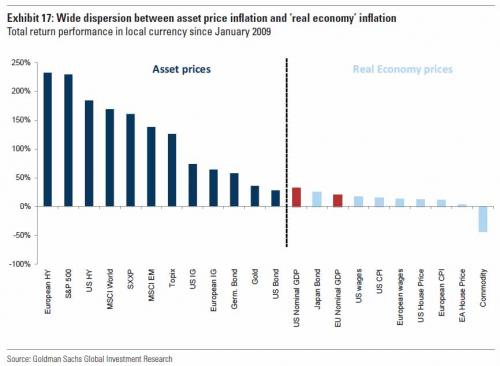

The following picture provides a good overview on the current situation. In fact, it shows indicators such as CPI and wages as well as returns on different asset classes since 2009. It is evident that not all of them exhibited the same behavior and highest variations (as much as 200%) are from those asset classes that were, directly or indirectly, target of APP (Asset Purchase Program), let it be Europe, US or Japan.

Source: Goldman Sachs Global Investment Research

Both choices (A and B) mentioned above are risky: history and macroeconomics teaches that printing money has only short-term effects and cannot be really used to provide stimulus to real economy for a prolonged time, and it could lead to disasters. However, it is worth noticing that, until now, no program similar to QE resulted in hyperinflation, not even in Japan where the BOJ has been easing since 2000 (also note that it was not 100% successful in meeting its inflation targets and that different methodologies are used). The main reason for this, says economic literature, is that “QE money” remains mostly in the financial system and the transmission system to final consumers is not perfectly working because of the too many intermediaries.

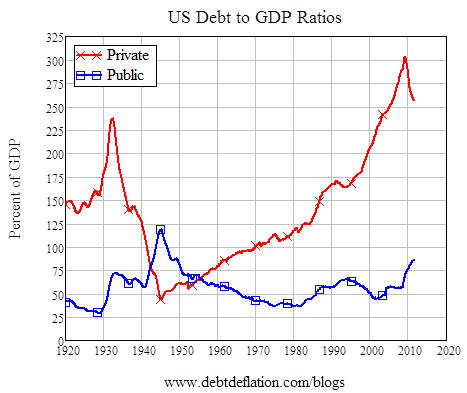

Anyway, try to imagine a scenario where central banks own larger and larger percentage of public debt (which is not too far from reality). It is very easy to imagine that such a case would not be possible without having negative general consequences. This – together with low or below zero interest rates – boost the credit expansion in way, which is considered by many, unnatural and not linked to real economic fundamentals. Most of orthodox economic economists do not see a relation between private debt and recession, but empirically this positive correlation can be seen very clearly in certain historic periods. On the other hand, for some countries, the level of public debt is not always correlated with the possibility of recession (for this it is critical to consider who are the debt-holders).

Source: debtdeflation.com

So far, the article was focused on providing a critical long-term analysis and to provide a brief recap of why the QE is not seen as a good solution by some economic agents. Soon it is expected that Draghi will progressively reduce the degree of purchases by the ECB to normalize monetary policy. Of course, this will not be easy to implement as it is critical to avoid adverse effects in the financial markets, particularly the bond selloff and abrupt appreciation of EUR. Anyhow, the structural reforms remain the most important goal for the long-term stability.

From the Last ECB’s meeting

The decisions announce on the last ECB panel meeting, held on the 26th of October were in line with the expectations:

– Deposit facility rate unchanged at 0.25%

– Marginal lending facility unchanged at -0.40%

– Main refinancing rate unchanged at 0.00%

However, Draghi has made some interesting comments, while answering to questions from the public, which we believe are very relevant, in particular:

– “QE will not stop suddenly” (it cannot go from 30bn to zero suddenly),

– “rates are expected to remain the same for a long time, also past QE-end” (although the majority of the commission voted for an open-ended QE, which means without a precise end-date)

As closing notes, he has remarked that:

– Core inflation fails to show an “convincing upward trend”

– Substantial step-up in policy reforms from all the players involved is necessary

Trade Ideas

In this part of the article, we will describe two possible strategies that differ on their risk.

EUR/USD

Source: Investing.com

We can see the formation of a head and shoulders bearish pattern in the Eur/Usd after the ECB dovish decision, it is likely that by the end of the next week this strong depreciation of the euro relatively to US dollar will continue bringing the exchange level near the resistance of 1.14, 6 figures below the maximum reached on September of 1.20 and 2 figures below the current level. The strong revers sign in the momentum of the Eur/Usd is also pointed out by the price breach of the 100 days daily moving average. Of course, this is the consequence of the immediate reaction of the euro area sovereign bond decrease in yields after the dovish decision, but in a long-term horizon we should not forget the relationship between interest rates and exchange rates defined by the interest rate parity. This relation implies that a rising spread between US and EU rates is likely to lead to an euro appreciation directly proportional to the spread and approximate by = i,US – i,Euro. Our prevision about the spread is that is going to increase in the next 5 years considering what Draghi said about a very long period of persisting low interest rates.

If an investor is inclined to risk and is willing to invest into European stocks, he could apply a tail-hedging investing strategy. In particular, he could invest the whole portfolio in a passive index (for example Eurostoxx 50) and purchase monthly put option out of the money with underlying the index itself. As Mark Spitznagel (a pioneer in this strategy) suggests, put-options should be purchased with strike price equal to 80-85% of the spot. To maximize the utility of this strategy it is recommended is to have higher exposure to stocks with high dividend yield to compensate the possible loss caused by payment of put options, because if the market does not crash, they will expire worthless.

Source: ITtrading.com

The economic reasoning that justifies this investment strategy is that Europe is still fragile (remember what happened during 2011) however, with economic indicators catching up, with no external shocks and with prolonged easing monetary policy, it is reasonable that equity markets will continue the upward trend. On the other hand, if a recession hit the global economy or Europe, the portfolio is protected from heavy downside risk with put-options.

Finally, as Nicholas Nassim Taleb (author of “The Black Swan” and advisor in Mark Spitznagel’s fund) suggests, tail-hedging strategies permit to have small returns when markets grow, lose a bit of many if the market falls shortly and make great returns when markets crash.

0 Comments