US

This week we have seen almost only positive data about US economy, which explained dollar strength with respect to all major currencies (EUR, GBP and YEN). Gains were relatively small against Euro and Pound. The substantial advance with respect to the Yen was mainly due to Yen’s weakness during the week.

Source: Investing.com

Data about inflation were unexpectedly strong. Core and non core PPI MoM bounced back from last month and exceeded expectations. This trend was supported by CPI MoM (though not from core CPI) which was flat instead of -0.1% expected. Building permits, housing starts and Philly Fed Manufacturing index came all out above predictions and managed to offset slightly higher than expected unemployment claims.

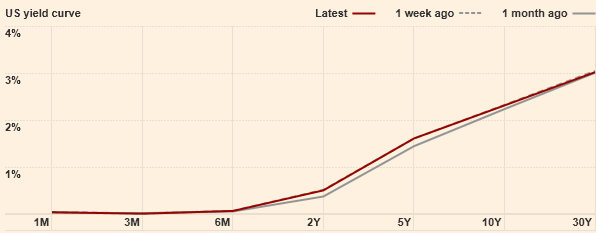

The highlight of the week was the release of Fed’s minutes on Wednesday. There was general agreement to end the QE programme last month. Even if close debate whether to drop or not the pledge to keep rates low for “a considerable time” took place, there is little confidence that this expression will be changed in December. A slight steepening in the yield curve resulted from the combined effect of higher than expected inflation and a dovish FOMC meeting.

Source: FT

For what concerns the 5 days period equity markets reached again record highs: the S&P 500 was marginally up closing at 2063.50 and so was the Dow Jones closing at 17810.06, both 0.52% higher than last week; the NASDAQ ended up at 4712.97, gaining 0.24% from last week.

A special mention to brent crude oil that, after months of downward trend (its price dropped by around 30% from mid June peak of 115.06$ per barrel), remained pretty stable this week and even closing 0.51% higher than last week at 80.37$ per barrel. Gold 100oz closed at 1200.30$ after a week of sharp positive trend gaining 0.78% from last week.

Next week we will be watching for the preliminary GDP QoQ, a measure that will come under strong pressure after disappointing growth in Japan and China. Among other closely watched indicators we have unemployment claims, New Home Sales and Core Durable Goods Orders.

EU

The week started with a positive mood as the confidence in Germany has returned back. The Zew indicator reported at +11.5, overcoming the less optimistic expectation of +0.5 and calming worries about the negative September figure (-3.6). On Thusday, the reporting of the Eurozone Manufacturing PMI at 50.4 vs 50.8 (expected) further confirmed the recent series of data indicating sluggish growth in the region. Consequently, in order to restore the confidence of economists, on Friday morning Draghi firmly confirmed its intentions to improve the troubling mix of low inflation level and sluggish growth. The bond-buying scheme will fight the weak confidence and low investment levels by boosting credit creation, weakening the Euro and easing the strain on households and businesses. The ECB announced that it had purchased €10.5bn of covered bonds as of last week and that corporate debt and sovereign bonds are not excluded from the shopping list for the early months of next year in case the economy needs them.

Hence, the announcement of a possible QE made the European stock markets rally. On Friday, FTSE MIB gained 3.9%, while the EURO STOXX 50 increased by 3%. The main indices were also supported by the unexpected cut by the Chinese central bank (one year deposit rate by 25bps to 2.75% and one year lending rate by 40 bps to 5.6%), which increased investors’ confidence in global growth.

With regard to the EURUSD, the exchange rate sharply dropped to a level of 1.2391. Italian 10Y BTP yield was down from 2.34% to record low 2.21%, Greece 10y government bond yield sharply dropped by 25bps from 8.20% on Friday morning to 7.95% and the German Bund fell back to 0.77% after an intraweek spike to 0.84%.

Source: Investing.com

UK

In UK markets the FTSE 100 continued to gain ground this week, closing 1.45% higher at 6,750.76. The index has been steadily recouping its losses from its trough in mid-October; however, it is still shy of its September high. Soft inflation figures for October that were broadly in line with expectations propped up the index slightly on Tuesday, while the release of the Monetary Policy Committee November meeting minutes held it steady on Wednesday. The minutes showed that of the nine members of the Committee, 7 voted for leaving the repo rate unchanged at 0.5 per cent. The main reason behind this decision is the absence of inflationary pressures in the near term and the risk of derailing the economic recovery. Indeed, as a complement to what we discussed in last week’s full-fledged report, despite the improvement in labor market conditions wage gains overall are barely keeping up with inflation, certainly a trend not consistent with wage-price inflationary spirals. More significant gains for the week came on Friday, although these were due mainly to unexpectedly positive monetary policy developments abroad, namely a dovish intervention by ECB president Mario Draghi and a surprise cut in interest rates by the People’s Bank of China.

Coming to UK rates, a pivoting of the curve around the 2-year tenor was seen as yields in the front end went up while those in the medium to back end came down. It seems that despite this week’s news, market participants are still pricing in an early rise in rates, although prospects for the long-term level of those are being diminished. At the moment 10-year gilts yield 2.05%, compared to 2.20% just one month ago, while the rest of UK rates can be seen in the chart below.

In currencies space, the British pound gained more than one percent on Friday vis-à-vis the Euro after Draghi’s speech, up to a level of 1.263 euros per pound, after previous days in which it traded sideways against both the Euro and the US dollar. The trend of gradual appreciation against the Japanese yen went on instead (the pound has gained nearly 7% against the yen since its lows in mid-October).

Next week we are expecting on Wednesday an estimate of GDP growth rate for Q3, which will provide hints as to whether the actual pace of growth around 3% can be sustained. Also important will be the Gfk data on consumer confidence, to see if the growth in output finally translates into higher consumption and discretionary spending in general.

JAPAN

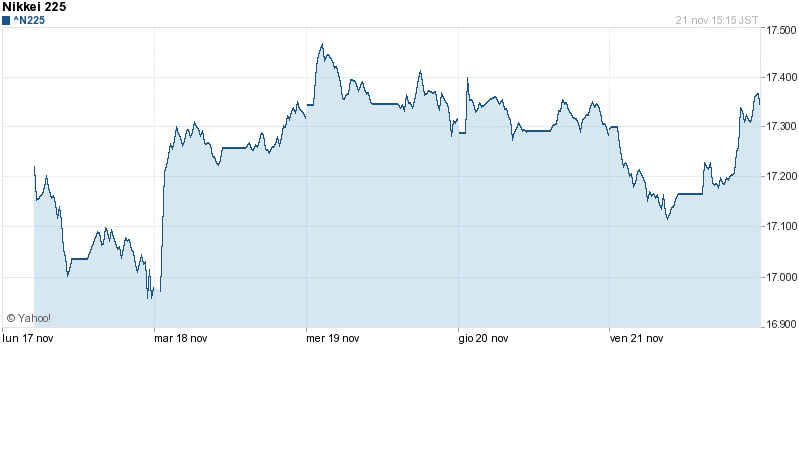

The past week has been an intense one for Japan’s economy, and in particular for its prime minister Shinzo Abe. One of his main targets, bringing GDP growth to 3%, has been clearly missed, since the data published at the beginning of the week confirmed its value to -‐1.6% annualized, moving the country into recession.

On Monday, the Nikkei 225 reacted opening at 17220.63 points, slumping right after the news to 16979.32, with an overall decrease slightly higher than 1.4%.

Since economic data reflect the questionable effects of “Abenomics”, the prime minister is not anymore convinced to win anticipated elections, in spite of the opposition being very weak in the country. This resulted in greater uncertainty about coming elections, which further amplified the downward trend.

The provision for what concerns a tax raise on sales increase from the current level of 8% can be central from a political point of view. The measure was scheduled for October 2015 but it is expected to be postponed to April 2016. Indeed the tax increase to a figure of 12% will definitely take place, as Taro Aso, Japan’s Finance Minister, declared on Tuesday the 18th.

The exchange rate for the Yen against the Dollar and the Euro showed higher volatility compared to the previous weeks, even if Aso expressed his concerns regarding a too volatile currency. However the whole week’s FX floating resulted in an appreciation compared to last week’s figures. The trade balance still reports a trade deficit, with a 35% reduction in October to ¥710bn, the lowest figure since June 2013. In conclusion the post effects of the end of the American QE and the rise of the US interest rates are expected to further depreciate the Japanese currency. For this reason we would suggest to keep open the short positions on the Yen against Dollar in order to make profit from this possible depreciation.

Source: Yahoo Finance

[edmc id=2230]Download as PDF[/edmc]

0 Comments