Introduction

Exchange Traded Funds (ETFs) have constantly been on the rise ever since the 2008 financial crisis. Year over year, increasing amounts of assets are placed in ETFs causing their market share (especially in the United States) to expand to over 25% of total open-end funds in 2018 according to EY. This leads us to ponder more specifically in what ways the ETFs impact the market. This question gets especially interesting when considering that ETFs are by definition supposed to replicate the performance of their native indices. Hence, they are usually not designed to outperform the market, but rather to replicate its yield and return, either as a whole or that of a specific sector.

After the 2008 financial crisis, investors started heavily doubting the worthiness of the hefty fees they paid to managers of mutual funds who weren’t able to protect them from the 45% drop of the US equity market. Many asset management firms noticed that and capitalized on the idea of people becoming wary of their money being actively managed by a different party, as they were not able to generate profits that were exceeding those of the market. Hence, with the ease brought by technological advancement, firms such as Blackrock and Vanguard started expanding their ETF business. Within it, there was no need for hiring executives with vast experience and placing a large responsibility of stock picking for billions of the clients’ money. Instead, all the ETFs had to do was replicate popular indices that investors wanted to follow to generate the same gains. The costs for operating the ETFs are marginal, as nowadays, adjustments in the exposure to each security within the fund are done through a computer algorithm.

Active investing in the era of ETFs

However, it is worth noting that Actively Managed ETFs do exist. In principle, they are very similar to their traditionally passively managed peers, but their managers may change allocations or deviate from the tracked index when seeing potentially greater alpha. While the level of responsibility possessed by the managers of such ETFs isn’t equivalent to that carried by mutual fund or hedge fund managers, ultimately, investors do rely on their decisions in making profits, and no longer have as clear of an outlook as the one that comes with following the market. Furthermore, most research points to the conclusion that actively managed ETFs aren’t able to constantly one-up the market, and hence passive investment strategies are stronger in the long-run.

Besides the lower costs, ETFs present a perfect opportunity for young investors wanting to enter the stock market. Oftentimes, this crowd doesn’t have substantial savings to pay for the management of their money and does not possess professional stock market knowledge to stock-pick themselves. As they observed an attractive recovery of the US stock market post-2008, ETFs presented them with the most direct and potentially liquid option to capture some of the gains. While retail investors certainly played a huge role in the rise of ETFs, with data showing that they are the most common financial instrument in their portfolios, ETFs are now also instruments used in the professional world in order to secure market gains.

US investors held $3.4T in ETFs in mid-2018. In comparison, the market cap of the S&P500 around that time was $23T, and the market cap of all domestically listed companies in the US hovered around the $32T mark at the end of 2017. This shows just how big of a portion of the market is affected by financial instruments that replicate it.

Naturally, this has consequences on the behaviors of the market. Many are quick to point out an increasing trend in US stocks moving more abruptly according to macroeconomic news. The general health of the markets is no longer only centered around quarterly releases and outlooks, but rather travels heavily up and down based on political decisions that impact the economy as a whole.

These consequences of an increased market share of ETFs in the stock market are really important for active investors as they will have to increase the weight of the general market sentiment in their investing methodologies.

Users of ETFs

As we have previously discussed the rise of ETFs as a dominant financial instrument (partially credited to young investors), it is important to delve deeper into the types investors that use ETFs and their specific characteristics that effect how and which ETFs that they use.

Retail Investors: The rise of the notion of passive investing has created a significant demand for index tracking ETFs from the retail investor segment of the market. Dominant ETF managers including Blackrock under its iShares brand, Vanguard, Invesco and DWS’s X-Trackers ETFs have been rapidly expanding the scale of their ETF business while competing for higher diversity in terms of offering more tracked indices to investors at low costs. With the development of the scope of the market, we can say that retail investors can build an ETF-only well-diversified portfolio in terms of assets and regional exposure. The sources of retail demand are not only the low costs and the opportunity to diversify, ETFs have created an image of being totally liquid assets and the opportunity to quickly buy/sell ETFs at most market conditions have contributed to the retail investor’s love for ETFs.

Hedge Funds, Active Investors: While some hedge funds and active investors share the passive investing way of using ETFs like retail investors, there is some

Mechanics of ETF Trading

The reasons for the fear that is building up can be understood if we take a look at the mechanics of ETF trading:

The market of an ETF consists of two layers: the secondary market and the primary market. Suppose that you want to buy an ETF, there are two ways that this trade can be executed:

- Your order can be matched by sellers in the secondary market. This layer of the ETF has the same structure as trading stocks.

- However, if your order exceeds the capacity of the secondary market your trade goes into what is called the primary market. The primary market trading of an ETF is intermediated by two types of institutions (The ETF Manager and an Authorized Participant): the AP contacts the ETF Manager and has to either deliver the securities or the cash for the creation of the ETF demanded. Once the ETF Manager receives the basket of securities or the cash needed to assemble the basket, it delivers the demanded amount of ETF shares to the AP in order to be sold to the customer. Furthermore, the redemption process in the primary market works as the opposite of the creation process. Therefore, when the AP wants the redemption of a number of ETFs and it contacts the ETF Manager, the ETF Manager delivers either the basket of securities that the ETF shares represent or the cash that the basket is worth to AP.

Liquidity in ETF Trading

The ETFs have different sources for their liquidity. The most visible one is the secondary market trading that is also supported by market makers’ trades. The market makers serve to guareantee both liquidity and stability in the ETF markets. There is also what the ETF managers generally call the “hidden liquidity”, which can come from lower bids and higher asks that might not be shown in the trading platform that a retail investor looks at or from the rare over-the-counter (OTC) transactions that happen. Lastly ,there is the most important source of liquidity for ETFs: liquidity of underlying assets. As the ETF creation and redemption are possible, the underlying assets determine the total market liquidity by setting the time needed for the creation and redemption.

As we described in the previous paragraph ETF liquidity has three sources: underlying liquidity (the most important source of liquidity), the hidden one, and liquidity in the secondary market. This structure and the nature of being a publicly traded security creates an image of maximum liquidity on the investors’ mind. And the low liquidity risk perception is true most of the time for most of the ETFs. However, as the ETF world has evolved during its exponential growth journey, we believe that there are several types of ETFs that can face liquidity problems.

Net Asset Value vs. Price of an ETF

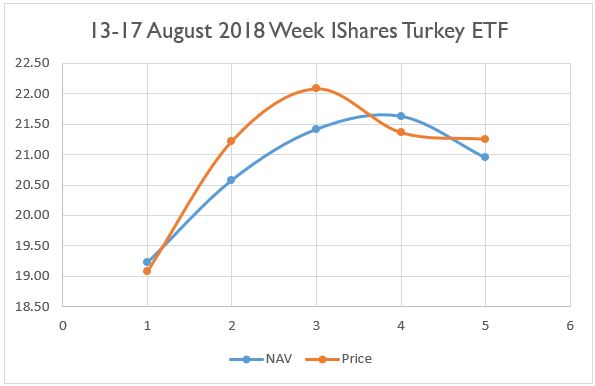

As the underlying liquidity is the most important factor for ETF liquidity, we believe that in cases of significant market panics ETFs can damage investor portfolios. To understand this, we need to understand the difference between the net asset value per share and

However, NAV is generally not the price paid for buying an ETF share or the price received for selling it. As ETFs are securities traded in exchanges, their price also depends on supply-demand dynamics of the given instrument. In theory, any inequality between price and NAV of an ETF would be fixed by arbitrage trades in which market makers and APs would engage. Nevertheless, there have been plenty of cases in which arbitrage opportunities were not exploited by investors due to market volatility. Now we will introduce a case study to show how considerable difference can exist between the NAV and the price.

Country Specific EM Equity ETFs

2018 has been a tragic year for Turkey: an extremely bearish stock market was combined with the significant depreciation of the Turkish Lira. Turkey had been one of the most charming emerging markets for foreign investors before the recent downturn. This charm has led to the creation and

This table shows us the top 10 trading days with

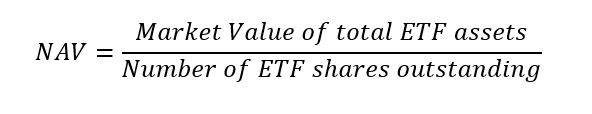

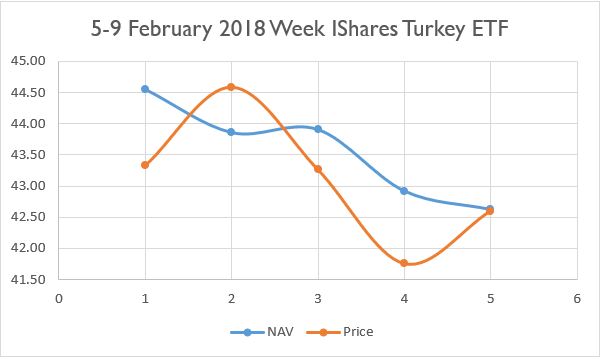

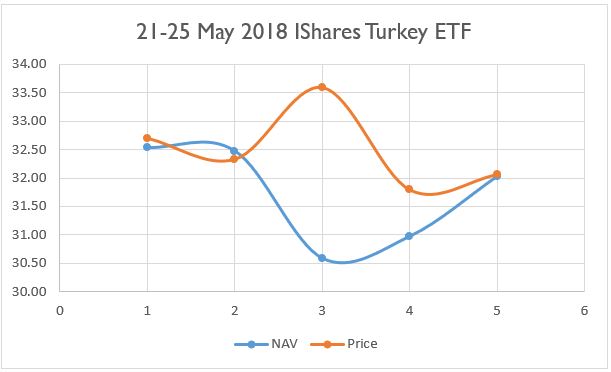

These three weeks from 2018 show us how turmoil in markets can have bigger implications to ETF investors. Some of the challenges that holders of the TUR ETF have faced during these events were due to the considerable differences between NAV and the market price of the ETF. Hence, investors were not able to healthily trade the underlying securities using the ETFs. As these cases can be considered as market panic, we recognize that even if the investors were to trade the Turkish market using stocks, their movement capacity could have been limited. However, ETFs do increase the magnitude of the limited movement ability as they can also lose their perfect correlations with the underlying securities. The duration of the loss of correlation is also important as ETF investors would not have the chance to move out or add exposure to these ETFs at fair prices representing the underlying securities during these events for several days.

This characteristic of ETFs is especially important for institutional investors as they tend to demand shorter times to add or reduce exposure. Institutional investors such as hedge funds have recognized this problem and they have started to engineer more convenient ways to position in such markets. Nonetheless, retail investors do not have access to such instruments. On the other hand, this paired with the subject events has not produced noticeable discouragement from investing in ETFs, but this should not mean that retail money will trust ETFs forever. If this type of divergence does happen more often or ETFs that have larger weightings in the retail portfolios also face divergences, retail investors will also start moving out from these ETFs. As a result, the outflows might increase the divergences as they will propel the liquidity problems of ETFs. Therefore, we believe that ETFs that can face problems such as the TUR ETF must be analyzed more profoundly and the liquidity of these ETFs in times of market turbulences should be considered carefully.

Credit Fund Risks

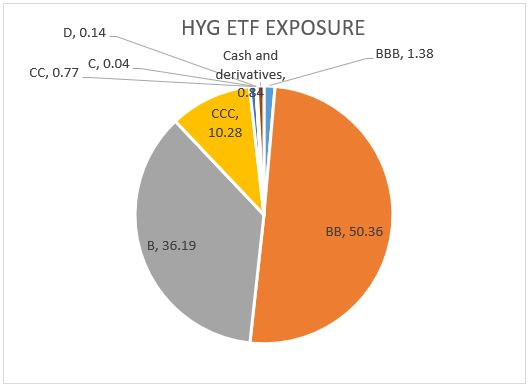

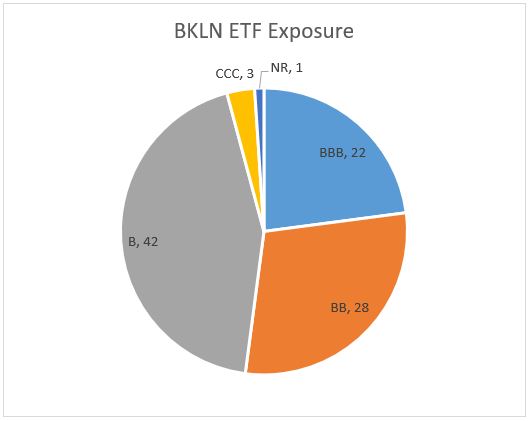

Another type of ETFs that can threaten investor liquidity are non-investment grade loan funds. Non-investment grade debt and ETFs have different characteristics: ETFs are supposed to be liquid and their demand also origins from the perception of their high liquidity. Non-investment grade debt tends to be illiquid and moving out from these instruments can be a challenging and long process. Below, we will present two different ETFs with such characteristics: iShares High Yield Corporate Bond ETF and Invesco Senior Loan ETF.

These exposures must be treated carefully as they represent an important share of a portfolio for investors. While it can also be argued that the liquidity of developed market equity ETF holdings is way higher than emerging market equities such as Turkish stocks, it is key to highlight that such mismatches can happen in other aspects of ETFs such as these high yield credit DM ETFs.

Conclusion

As a result, we believe that the surge of ETFs has brought benefits to investors such as access to markets that retail investors would not be able to reach in the absence of these instruments, lower cost of trading, and higher ability to diversify properly. However, all these benefits come with costs, which are paid by the market structure and investor liquidity. We believe that ETFs have greatly changed how investing functions, but it is key to stay aware of the fact that ETFs can have liquidity mismatches with their holding securities in some events, such as market panics that have happened in Turkey.

0 Comments