As the automotive industry evolves towards EV’s (electrical vehicles), an analysis of all the new commodities that will be used in the sector, in particular the battery sector, is required. EV batteries are made of an anode and a cathode. The anode is always made up of graphite, while the cathode has several different “formulas” depending on the manufacturer: the most common materials used are lithium, cobalt, nickel, manganese and aluminium. Due to the mature supply chain of aluminium and manganese, we decided to analyse the following materials: lithium, cobalt, graphite and nickel.

Graphite (Anode)

In the electric vehicle industry graphite is used as the anode for the car batteries. All manufacturers of car batteries use graphite in the anode, but some mix it with silicon. Silicon produces 10 times more energy than graphite, but also it expands due to its high energy density by 400%, significantly reducing its durability and hence forcing manufacturers to only use or mostly use graphite.

Graphite is a special commodity: it can be produced synthetically, but also naturally by mining it. Synthetic graphite is more expensive and heavily polluting to produce, but has a higher purity. While natural graphite is cheaper and less polluting, it requires processing to improve its purity. Originally, natural and synthetic graphite didn’t compete with each other in the same market: Synthetic graphite is used for the production of graphite electrodes, a necessary component for steel production, while natural graphite is mostly used as a refractory (heat resistant) material for crucibles, which are used for smelting. Today however there have been improvements in the average purity of natural graphite resources, which make its processing cheaper and its achievable purity comparable or better than that of synthetic graphite.

For the EV industry, of main interest is spherical graphite, which can be obtained from both natural and synthetic graphite and is used for the production of BAM (Battery Anode Material).

Worldwide production of natural graphite is concentrated in China, India and Brazil, but Mozambique is expected to surpass the latter in production in 2018. The total worldwide production is 1200 KT.

While prices for natural flake graphite have remained relatively flat in recent years, the prices of natural/synthetic graphite derivatives such as spherical and electrode have instead increased dramatically in 2018, with electrode prices increasing up to a maximum of ten-fold during the year and spherical graphite being priced at 3 times the average spot price of large flake graphite. This is due to the fact that China, which is the only country in the world to currently produce spherical graphite and the main producer of graphite electrode, has recently clamped down on its entire graphite industry, closing down both natural graphite mines as well as spherical and electrode plants due to environmental concerns.

It is hard to forecast the trend for supply/demand dynamics. On the supply side much will depend on developments in China. While natural graphite, together with many other minerals and rare earths, was explicitly exempted from the recent US tariffs, if the trade war escalates, as Africa ramps up graphite production, the US might not be so dependent on China for imports of this commodity and decide to apply tariffs anyway, damaging worldwide supply. In addition, Chinese policy for the environment could at least temporarily cut down supply in China.

On the demand side everything will depend instead on EV penetration and the stability of the highly cyclical steel industry. In particular, Tesla’s Gigafactory alone will require up to 93 KT natural graphite yearly at full capacity.

Today, the market for natural graphite appears to currently be slightly oversupplied, as several graphite miners reported lower sales prices than those expected from external benchmark providers. This is mostly due to the recent increase in production coming from Mozambique, which is expected to reach at least 100KT by the end of 2018 (a 8,3% increase in worldwide supply) and more than 400KT (more than a 33% percent increase) in the following years depending on ramp up. However, if EV market penetration is strong and/or China continues to close down its mines/the trade war escalates prices might increase at least till 2020, when several new mines will enter into production and ramp up. The market is currently discounting oversupply as share prices of graphite mining firms have significantly decreased YTD.

Lithium (Catode)

Lithium is the best commodity on the market because of the amount of electricity stored for kilograms per dollar price.

First commercialized by Sony, in 1991, it in twenty years this technology has secured its place involving more and more sectors (from technology to transports). Obviously, the amount of lithium used, highly depends on the usage: think that an iPhone battery contains less than 25 grams while a Tesla around 60 kilograms.

Lithium demand grow double-digit yearly.

The demand increases due to wider utilization in several areas of human life: given for consolidated the amount used for electronic devices (smartphones, tablet and pc), there are other fields where the usage of lithium is literally skyrocketing.

As it can be noticed by the graph, EV are becoming a fundamental driver for the lithium demand. Think that in 2015, 500 thousand EV have been sold out of 72 million vehicles: which means that EV with a 0.6% market-share already absorbed 15% of world lithium demand. Furthermore, in the next years EV sales might beat forecasts: this might happen if EV offer would become more variable and cheap, if oil price would increase, and if governments would create further incentives.

Moreover, previsions don’t consider that in the next years we might assist to the electrification of other means of transport like motorbikes, minivan and trucks, that would improve the perspectives of lithium demand.

In terms of supply, Lithium is the 25th existing commodity in term of abundance with about 14 million of tons in reserves. Unfortunately, only a part of it is located above ground or in geological areas allowing extraction with sustainable costs.

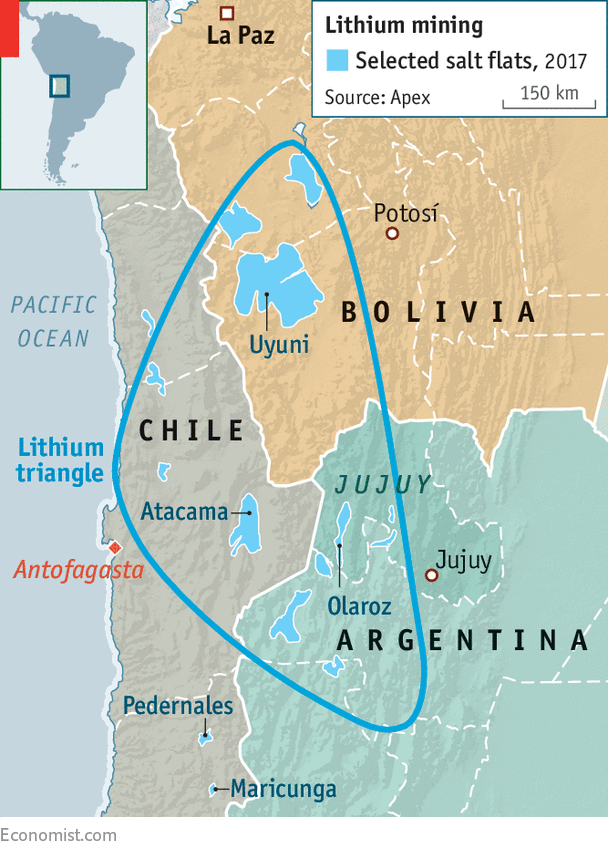

More of 50% of known reserves are located on the “lithium triangle” that is shared by Bolivia, Argentina and Chile.

Source: Economist.com

The lithium world production identifies as most important countries: Australia, Chile and Argentina and most important lithium miners are the Chilean Sociedad Quimica y Miniera De Chile, the American Albemarle Corporation and FMC Corporation and the Chinese Tianqi Lithium. These societies during the last years have started to acquire junior miners and new mines. Furthermore, during the summer, Tianqi Lithium has tried to take over the Chilean SQM, but the operation has been stopped by the Chilean government. Overall, the big picture underlines a highly concentrated sector with four societies controlling over 50% of world supply.

Lithium is a relatively young commodity for investors and is not purchasable through futures yet. Lithium prices have been very volatile in the last few years as demonstrated by the following chart.

Source: Tradingeconomics.com, OTC

The only way to take part to lithium growth is to acquire a participation in lithium miners. The recommended strategy is a simple BUY and HOLD on a basket of major lithium producers with a small percentage of financial portfolio, below 5%.

This sector, in fact provide both opportunity and risks: seen the demand perspectives is plausible that in few years stock prices might skyrocket but on the other hand is exposed to technologies and supply risks in addiction to markets risks. The first one means that exists the probability (even if very small) that an alternative technology to Lithium-ion batteries is developed in the next years and the second one, supply risk, means that being nowadays lithium considered as rare commodity and being is priced in miners stocks, if new mines were discovered, actual ones might be devaluated.

Cobalt (Cathode)

Cobalt is a chemical element with symbol Co and atomic number 27. It is mainly obtained as a co- and by-product of copper (46%) and nickel (39%) mining and only the remaining percentage from mines where cobalt is the primary objective.

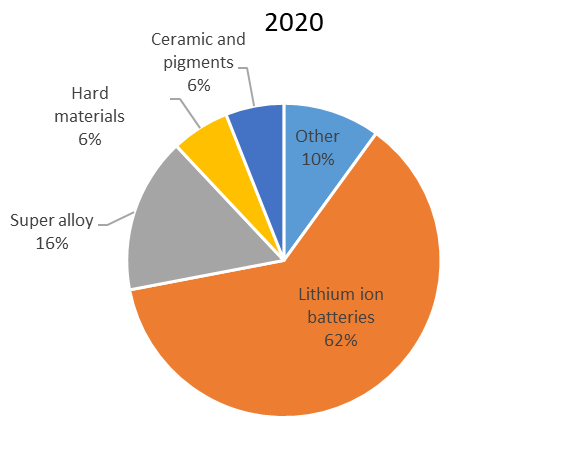

Cobalt applications can be subdivided into two broad segments, chemical and metallurgical. Chemical applications consists of the rechargeable batteries segment: key uses are for Li-ion batteries for electric vehicles (EVs), Li-ion batteries for other applications (laptops, PCs, smartphones etc.), polyester and tires. Instead, metallurgical uses consists mainly in high temperature alloys. Key sectors include super alloys (aerospace rotating parts, defense, power generation, thermal sprays, prosthetics etc.), high-speed (HS) steel, carbide and diamond tools and magnets.

Source: Darton commodities

Cobalt is a key ingredient in lithium ion batteries, and is used to extend their lives. Projected battery consumption is expected to account for about 60% of all cobalt demand in 2020, representing a 58% increase in battery demand from 2016 levels. The major driver of this consumption comes from the strong demand for EVs that we have seen in recent years and which is expected to be stronger over the next decades.

For that reasons, cobalt demand is expected to exceed 120,000 tonnes per annum by 2020, up approximately 30% from the 93,950 tonnes consumed in 2016.

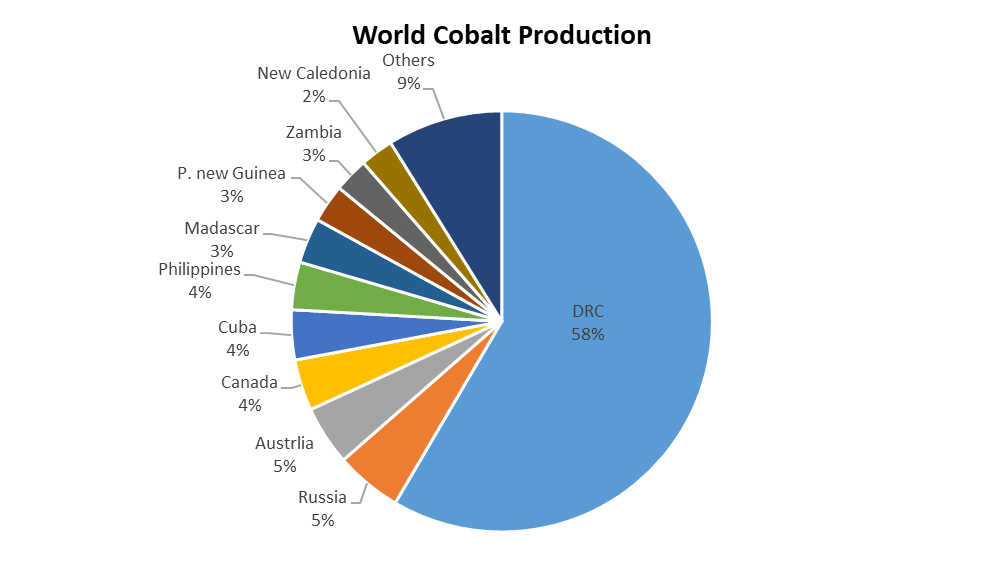

In terms of supply, most of the cobalt is extracted from the DRC, the democratic republic of Congo, which accounts for about 60% of global cobalt production. Other major countries where this metal is mined are Russia, Australia, Canada and Cuba.

Source: U.S. Geological Survey 2018

Although Cobalt is mainly mined in DRC, it is only responsible for 0.4% of global refinery production. On the other hand, it is the major provider and supplier of materials for China’s production of refined cobalt. Not surprisingly, China is the largest producer of refined cobalt, accounting for 46% of global production in 2016.

Since 46% and 39% per cent of production of cobalt is closely linked to copper and nickel production respectively, it is a base metal that depends on to these 2 material global production.

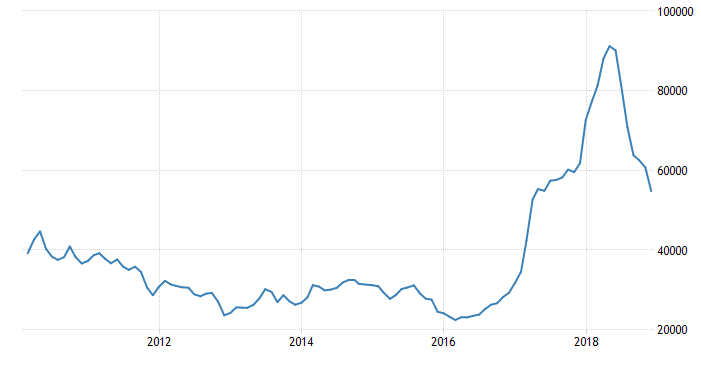

Currently, Cobalt is trading at 55.000 $/tonne. Since 2000, cobalt demand has begun to rise progressively. The main driver of the growth was the strong demand for rechargeable batteries, initially used in electronic equipment.

Source: Trading Economics

Cobalt production mine increased by around 270% from 34.000 tonnes in 2000 to around 126.000 tonnes in 2016. Price remained relatively stable and low until 2017, when concerns over cobalt supply in the context of soaring demand for batteries for transport and EVs, together with concerns over long-term access to cobalt resources following instability in DRC, pushed the price higher. The metal almost quadrupled over 2 years, by touching in March its highest point at 95.250 $/tonne driven by strong demand for the metal.

However, during the Q3 2018, the metal lost almost one third of its value. It was mainly due to oversupply coming from China. It happened because of an oversupply of cobalt sulphate, which is the chemical form of cobalt used in batteries. The oversupply caused the chemical form to be trading at 1.5000$/tonne at discount compared the metal form of cobalt. Given the price gap, it encouraged some of the Chinese refineries to produce the metal instead to export to the United States and Europe. It lids to a higher production of the metal.

The oversupply in cobalt sulphate was caused by a massive increase in cobalt exports from the DRC from both the artisanal and conventional sectors.

As Mentioned earlier DRC is the major supplier of Cobalt in the world and due to its political instability, it is one of the factors that can influence the commodity price. The country and companies operating country have been under attack by different global organizations for pour labor conditions, human rights abuse and child labor issues in Congolese mines.

Moreover, the political instability of the country is due to its controversial president, Joseph Kaliba. He refused to leave the office when its term expired in December 2016. Elections are expected in December 2018. However, the vote with a lot of difficulties will be fair and credible, and more controversies are expected and in the worst case scenario the return of civil war. Moreover, the country is currently under pressure due to Ebola. Experts consider it to be the second largest outbreak in history, it could force miners to lock down operations.

All these issues can influence and be disruptive in terms of supply side.

In terms of investment, we remain positive on the metal at current price, which is almost one third lower than the maximum touched early this year. Its demand is expected to increase due to the demand for lithium-ion batteries in electric cars. Disruptions in the supply coming from DRC could be expected and it would be supportive for the price.

Some car makers, such as Tesla are trying to reduce the amount of cobalt in their batteries but eliminating it entirely seems to be difficult because of safety issues. It provides stability to the battery in order to allow it to be charged and discharged continually without problems.

An investor can take exposure by investing in Cobalt futures contract that can be found on the London Metal Exchange under the ticket (CO). These futures began trading in early 2010 and are quoted in US dollars per tonne. Alternatively, it could be suggested to take exposure by investing in a basket of miners which have exposure to the metal.

Nickel (Catode)

Nickel is a chemical element that uses symbol Ni and represents 28th element in the Mendeleev’s periodic table. It is a silvery-white metal that is used mainly to make stainless steel and other alloys stronger and better able to withstand extreme temperatures and corrosive environments. It composes about 0.009% of Earth’s crust. Pure nickel is found in Earth’s crust only in tiny amounts. Use of nickel has been traced as far back as 3500 BCE.

Historically, it has been used for plating iron and brass, coating chemistry equipment, and manufacturing certain alloys that retain a high silvery polish, such as German silver. Nickel has been widely used in coins, though its rising price has led to some replacement with cheaper metals in recent years.

The metal is valuable in modern times chiefly in alloys – an alloy is a mixture of chemical elements, which forms an impure substance (admixture) that retains the characteristics of a metal; about 68% of world production is used in stainless steel. A further 9% is used for steel alloys and castings, 9% for non ferrous alloy, 8% in plating, 5% in fast-growing segment of batteries, and 1% in other applications.

There are 3 types of batteries powering EVs: NCA, NMC, and LMO. If we exclude lithium NCA and NMC contain 80% and 33% of nickel which shows its importance for EVs’ batteries.

Demand growth was steady at 5% in the last ten years, intensifying in 2016 and 2017 to more than 7% a year and creating a significant supply deficit in 2017 of more than 150 000 t, or approximately 7% of global supply. This push was mainly driven by EVs’ batteries growth. Nickel is widely viewed as the most important element for the EV batteries. As EV become more popular and ubiquitous on roads, demand for nickel will accordingly increase, not only because of higher number of batteries, but also because batteries are predicted to contain more nickel than today, analysts predict.

World production was practically unchanged in 2017. Production decreased in several leading producing countries. The largest decrease in production took place in the Philippines, because of the continued suspension of approximately 50 per cent of the country’s mining operations which is due to failure in meeting environmental standards. These decreases were offset primarily by increased production in Indonesia, which in January eased an export ban on direct-shipping ore for companies that intend to construct nickel-processing facilities. Furthermore, China is working on increasing its capacity.

Current price is $ 4.9775/lb. Nickel can be traded via futures.

Source: kitcometals.com

0 Comments