Facebook Market Cap (as of 21/02/2014): USD174.89bn

Facebook, Inc. the listed US based company headquartered in Menlo Park, California, has signed a definitive agreement on Wednesday, the 19th of February to acquire the venture-backed WhatsApp Inc for USD16bn plus USD3bn in restricted stock units (RSU from now on). The deal is the largest acquisition of a venture-backed company in history, which also clearly puts it in the early lead for the single biggest venture return this year. It should be enough to consider that by itself this exit would satisfy the IRR requirement of the whole USD1.3bn fund of Sequoia that invested a mere USD58.3mln in the mobile messaging company. Ironically, one of the two co-founders, Brian Acton, was turned down for employment by Twitter and Facebook in 2009, when he was seeking a job after nine years of experience at Yahoo Inc. as infrastructure engineer. Shortly after the rejections, he met with former colleague Jan Koum and together founded Whatsapp, which after only 5 years, made them billionaires thanks to the company that refused Brian Acton.

The total consideration agreed by Facebook will be paid both in cash (USD 4bn) and equity (USD 12bn). The equity part will be paid through the issue of circa 184mln shares, at a price of approximately USD 65.3 each based on the six-day average closing price preceding the announcement. Additionally, Facebook could pay up to USD 3bn, through the issue of another 46mln RSUs to WhatsApp employees which will vest in four years. The Class A common stock and RSUs issued to WhatsApp shareholders and employees upon closing will represent 7.9% of Facebook shares based on current shares and RSUs outstanding. The cash consideration will come from its reserves (USD 11.5bn as of 31 December 2013).

The eye-dropping price tag comes latest in a series of acquisitions in the social media industry. In 2012, when Facebook announced the acquisition of photo-sharing app Instagram for $1bn, several investors criticized the move and the size of the deal, but it has since proven to be a very profitable decision. Although Instagram wasn’t generating any revenue at the time, its growth potential and the possible synergies with Facebook made it an invaluable investment target. Indeed, since the acquisition, the number of the app’s users has increased from 30mln to over 150mln, new features such as few seconds video playing were introduced and a profitable business model, based on advertisement, was implemented.

Few months ago, Facebook was also the bidder for Snapchat, a photo-messaging app very popular among teenagers, valuing it at $3bn. Despite the fact that founder Evan Spiegel turned down the huge offer, we cannot ignore the characteristics that these companies targeted by Facebook have in common: a large, mostly young user base and all decisively mobile-oriented.

Upon completion, WhatsApp will continue to operate independently within Facebook with product roadmap being unchanged. It will keep its headquarters in Santa Clara, California. All of the employees of the company will be retained and Jan Koum, the CEO and co-founder, will join Facebook Board of Directors, which may very well be one of the reasons why WhatsApp turned down an offer made by Google for a total consideration of USD 10bn, as two unnamed sources tell Fortune. In fact, in addition to making a lower bid, Google also reportedly didn’t offer WhatsApp CEO Jan Koum a seat on its board of directors as Facebook did.

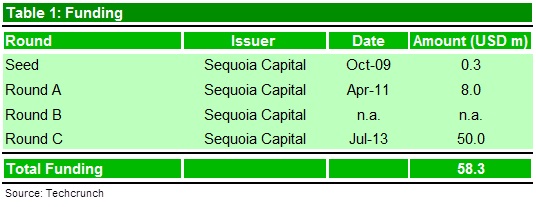

From a pure venture perspective, the purchase represents a huge win for Sequoia Capital. In fact, as shown in Table 1, while the only funding that WhatsApp had publicized was the $8 million Round A led by Sequoia, the company had raised two subsequent rounds of financing, including an unreported $50 Round C. Sequoia led both of those subsequent rounds, investing almost $60 million in WhatsApp over the years, which added up to a total ownership stake in the high teens, according to Techcrunch. Assuming such a level of ownership, Sequoia’ stake is now worth about $3 billion in cash and stock. The deal by itself could provide more than a 2x return on the $1.3 billion fund the initial WhatsApp investment came from and an astonishing 50x return on its investment in the company.

Source: Techcrunch

Sequoia estimates that 19% of the Nasdaq ‘s value is made up by firms they have funded. In fact, among its most successful deals there are Google, Yahoo, Paypal, Cisco Systems, Oracle, Apple, Youtube, Linkedin, Dropbox, Instagram… and now WhatsApp. Loking at these big names in the internet market what it’s actually curious is that the only one they apparently missed is just Facebook.

WhatsApp is engaged in providing cross-platform mobile messaging application. The company has around 50 employees in total, 32 of which are engineers, and over 450m people use its service every month 70% of which are active on a given day. That compares to Facebook’s user base of 1.2 billion and lower engagement level of 62%. WhatsApp also disclosed that its user base has more than doubled in the past year and it continues to add at least one million users every day. A surprising figure is that WhatsApp now handles more than 19 billion messages per day, a figure that is approaching the text message (SMS) volume of the worldwide telecom industry, estimated to be worth USD 100bn market.

Given the rapid growth of messaging apps and their popularity among younger people and outside North America, it should be no surprise that Facebook targeted WhatsApp. But isn’t the price too high?

A necessary caveat is that FB is capitalizing on all-time high share price, by paying 75% of the hefty price-tag with stock (almost 80% if we consider the RSUs); however, this fact by itself would not justify a wasteful deployment of resources and it is on the contrary quite clear that the acquisition of WhatsApp is a great addition to Facebook’s mobile strategy. In particular, WhatsApp has an excellent positioning in Europe, where it is dominant into every country while Facebook mobile messaging system (Facebook Messenger) is doing quite poorly and occupies a niche position. With Facebook’s expertise and resources, WhatsApp stands ready to further strengthen his leading position and take advantage of the rapid penetration rate of smartphones.

The 3-year CAGR in smartphone ownership between 2010 and 2013 is 46.5%, with global penetration just reaching 22% (or about 1.4bn smartphone owners). If we approximate the market share of WhatsApp with its Monthly Active Users (MAUs) and keep it constant (very conservative option since WA has grown its user base 115% in the last 9 months), we obtain 32% which we can use for a very quick-and-dirty, back-of-the-envelope valuation to judge whether the price paid is right. In a simplified DCF where WA does not change its business model, it is able to maintain a constant market share and smartphone ownership grows at a decreasing rate (stabilizing in 2021 at 5% per annum), the company will be worth a bit more than USD 16bn from the perspective of a buyer that discounts cash flows at a constant 9% rate, which can be reasonable for a large cap with an extremely light financial structure such as Facebook.

Therefore, it seems that even a quick valuation provides support in favour of the price, and we did not take into account any of the inevitable synergies bound to be achieved by the merger. There is also another important strategic factor that has been doubtless considered by Zuckerberg and his advisors, that is the need of Facebook to establish itself as firmly as possible as the leading firm in mobile messaging and user utility, avoiding the risk of extinction that entangled former shining stars of the social network firmament such as MySpace.

Facebook was advised by Allen & Company, LLC and Weil, Gotshal & Manges, LLP; and WhatsApp was advised by Morgan Stanley and Fenwick & West, LLP. The transaction is still subject to customary approval and closing conditions and full execution is expected by the end of August.

[edmc id=1371]Download as pdf[/edmc]

1 Comment

Trader Joe's · 22 February 2014 at 17:03

http://aswathdamodaran.blogspot.com/2014/02/facebook-buys-whatsapp-for-19-billion.html