In this article, we introduce distressed debt securities. Then, we investigate what are the problems of valuing a company in financial distress and how we can address those problems. Finally, we present some investment strategies that can be applied when a company is financially distressed.

Overview

Distressed companies are companies that are unable to meet, or have difficulties in, paying-off their liabilities. If severe financial distress cannot be remedied because the company’s obligations are too high and cannot be repaid, or if there is not enough cash to service the debt, then the risk of default becomes significant. Distressed debt investing is usually defined as becoming a creditor of such a company. Bonds are not the only investable security, as the investor can decide to take positions in other components of the capital structure (e.g. bank loans). Finally, “distress” can be related to multiple stages of the life of the company. For example, it may be likely to default, but still solvent or, as in other cases, the firm could be already under restructuring/reorganisation, bankruptcy or liquidation.

Even though the definition is not rigid, distressed debt securities have been traditionally classified as securities with a spread higher than 1,000 bps over the comparable Treasury yield rate.

There are several reasons why a company can become financially distressed:

- Performance problems

- The firm could be negatively affected by an economic downturn

- The company’s performance is declining due to a change in the competitive landscape or to a drop in profitability

- The company would work properly but its business plan is unrealistic and financial issues arise from the company’s operations

- Excess of leverage

- Incapable or conflicted management

- Liquidity issues

- Violation of a bank covenant: in this case, the bank could force the debtor to pay additional fees or to repay the debt

- Coupons payments: if a coupon’s payment becomes questionable, then the value of the bond would adjust consequently

- Lack of access to the funding market

- Unexpected liabilities

- Tort claims arising from lawsuits or other situations

- Contract liabilities: change of circumstances can make contracts’ terms unwanted and problematic

- Other idiosyncratic causes

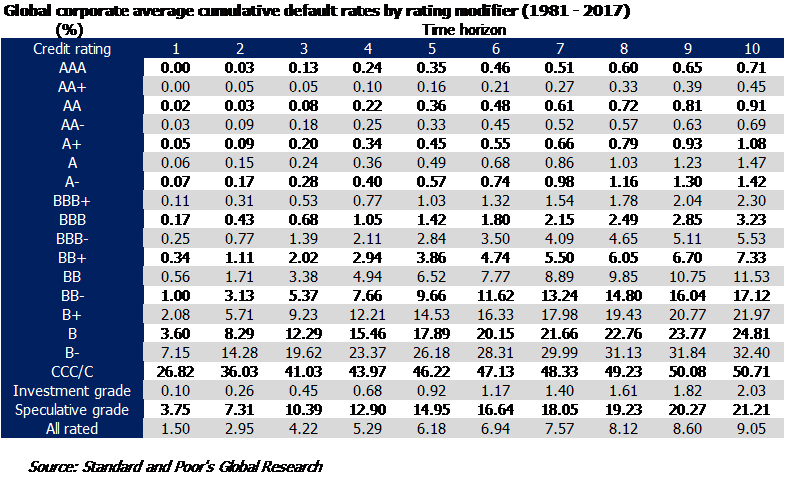

One key point in the analysis is to forecast, if not happened yet, whether the company will default. Besides fundamental analysis, there are various methods to forecast default probabilities. One quick estimate is the historical default rates related to the security’s credit rating. However, sometimes the rating revision may lag and investor’s analyses may differ from the rating agencies’ models.

Source: Standard and Poor’s Global Research

Scholars have also developed statistical models which try to predict the bankruptcy likelihood. One of the oldest and most famous is the Altman Z-Score, which takes as input accounting ratios. Finally, investors can use credit risk models that give estimates of default probabilities.

The other key input in assessing the price of the bond is the recovery value. The general recovery rate implied by the market is thought to be around 40%, However, the actual recovery rate may significantly differ from this value. Thus, the investor must carry out a thorough analysis of the company’s value and understand how it is distributed across different securities. To this purpose, it is fundamental to carry out legal analysis, to have a clear understanding of each security’s seniority and of the consequences that different legal proceedings may have on these.

Valuing a company in financial distress

Problems

The problems in the valuation of financially distressed companies arise from one particular assumption that forms the base of traditional valuation techniques. The assumption of going concern assumes that a firm has continuing operations and that there is no significant threat to these operations; but if the risk that the firm will not survive in the immediate future is significant, then traditional valuation models may overestimate the value of such firm. In fact, the assumption of going concern plays a significant role in both DCF and relative valuation: in the former, it affects the terminal value, which is usually computed through a perpetuity, while in the latter it shows up implicitly by valuing the firm based on other firms, most of which are healthy.

Why the DCF is not enough?

Before dealing with DCF solutions to the distressed companies problems it is worth mentioning that some objections have been made to these problems regarding a DCF valuation. In fact, it has been said, in defence to the DCF, that either we do not need to consider distress in the valuation or that distress is already in the valuation. We will see the objections ( and their counter objections) that have been made, with the first three related to the first defence of DCF and the rest related to the second.

- If we assume that there is unrestricted access to capital, no firm that is worth more as a going concern will ever be forced into liquidation. The problem is that access to capital is not unrestricted, especially for firms viewed as troubled by the financial markets or that operate in a depressed financial market.

- We usually value large market-cap firms that are traded on major exchanges; these firms are less likely to default. The problem is that there are several examples of large firms that defaulted.

- Firms that default will be able to sell their assets for a fair market value, which should be equal to the expected operating cash flows on the assets. The problem here is that the need to liquidate quickly the asset makes this situation unlikely.

- We could adjust the expected cash flows to reflect the probability of distress so that if the likelihood is high the expected cash flow should be lower. The problem is that it is very hard to implement: DCF does not consider the likelihood in any systematic way. In addition, even if it were, you would implicitly assume that the distress sale proceeds will be equal to the present value of the expected cash flow.

- The WACC can be adjusted for the probability of distress, by estimating the beta used for the cost of equity using the updated D/E and by increasing the cost of debt to reflect the current default risk of the firm. The problem is that the solution doesn’t adjust for the truncation of cash flows but only for their additional volatility.

Solutions for the DCF valuation

There are four ways to deal with distress in DCF valuation: using simulations or using a modified discounted cash flow valuation or using a going concern DCF value with adjustment for distress or with an APV model.

-Simulations

You can use probability distributions for the inputs into DCF valuation, you run Monte Carlo simulations and allow the possibility that the firm hits distress condition previously set. After that, you compute the value of the firm each time according to the situation, and then you estimate the expected value across repeated simulations.

-Modified Discounted Cash Flow Valuation

If you can come up with probability distributions for the cash flows, you can estimate the expected cash flows in each period, which should reflect the likelihood of default. For the calculation of the discount rate, you should use bottom-up betas and updated measure of D/E and default risk to estimate respectively the cost of equity and the cost of debt. In case it is not possible to estimate the entire distribution, you can estimate the probability of distress in each period and compute the expected cash flow as follows:

![]()

-Going Concern DCF Value with Adjustment for Distress

Under this method the value of equity is calculated in the following way:

![]()

After having estimated the value of the firm as a going concern you need to estimate the cumulative probability of distress over the lifetime of the DCF analysis, often 10 years. There are three ways to estimate such probability: using bond rating, using a probit model or looking at the market value of bonds. Lastly, we need to estimate the distress sale value of equity, either as a per cent of book value or as a per cent of the DCF value estimated as going concern. It is crucial to calculate the value at which the company could be liquidated, and depending on the nature of the business and of the assets, diverse firms may have very different liquidation values.

-Adjusted Present Value Model

With this method the value of the firm is written as follows:

![]()

where the firm value can be estimated by discounting FCFO at the unlevered cost of equity, the tax benefits are the present value of the expected tax benefits and the expected bankruptcy costs can be estimated as probability of distress multiplied by the difference between the unlevered firm value and the distress sale value.

Solutions for the Relative Valuation

In the case of relative valuation of distressed companies usually, revenues and EBITDA multiples are the ones used more often. The reason is that other multiples such as P/E or price to book value often cannot even be computed for distressed firms. There are three different ways to deal with distress in relative valuation:

- You can choose only distressed companies as comparable firms. But unless you have many distressed firms in that industry it will not work.

- You can adjust the multiple for distress, using objective criteria. Although finding objective criteria that work well may be difficult, an example is adjusting the average value to book capital ratio for the bond rating.

- You could apply the average value to book capital ratio of the industry to value the company as a going concern, and then use the same approach we used in the DCF to adjust for distress value sale.

Investing Strategies

The spectrum of available strategies varies with the time horizon of the investor and with the stage of the life of the distressed company. We now present some common strategies.

Active Controlling strategies

These strategies aim at taking a significant stake at one or more levels of the capital structure (e.g. subordinated bond and bank loans), trying to get control of the entire entity as a result of the restructuring. This investment approach resembles the one used by private equity firms, but in this case, the investor tries to take over the company by targeting debt, which he aims at converting into equity through the restructuring. Nonetheless, even debt investors may need to recapitalize the target company to guarantee a correct turnaround.

A similar strategy is to build a stake in different companies within the same industry to implement a roll-up strategy and trying to improve the combined company. The investment is successful if the post-restructuring equity value is higher than the initial investment.

Active Non-controlling strategies

In this case, the investor will try to build-up a debt stake in the troubled company, to become a member of the creditors’ committee and to influence the outcome of the restructuring. Differently from the previous strategy, the holding period happens to be shorter and the investor may not be interested in gaining control of the whole firm.

One more niche strategy is the one employed by the so-called litigation funds, which are highly specialised investors that buy companies’ claims against other parties. Often, companies which are in financial distress lack the resources to carry on expensive lawsuits. Thus, the management may be willing to liquidate the claim even at discount.

Manufactured defaults

Manufactured defaults are events in which a company, even though still solvent and with enough liquidity to face its due obligations, decides to default on its debt. One possible reason, as happened in the past, is that an investor is willing to provide other financial benefits to the company (e.g. cheaper cost of debt). In the meantime, the same investor has a long position CDS, and thus receives the contingent payment from the protection seller. However, recent developments in CDS regulation and on the definition of credit event has reduced these potential obscure situations, even though part of the risk still lies in the specific terms of the derivative contract. If the reader is interested, BSIC already wrote on this topic in the past.

Purely Directional Strategies

One common type of strategy is to go long on the debt by purchasing bonds, loans or other obligations. The investor may be bullish on the company, thinking that business conditions will improve and that the company will be able to improve its financial shape. In this case, there is the prospect that the bond will rise back to par from the discounted price it had before, or at least that it will register a significant increase in price. Similarly, if there is an ongoing lawsuit and the investor believes that the odds that the company will be judged guilty are overestimated, then he will consider taking a long position in the bonds.

Similarly, the investor can decide to sell protection on the company’s debt if he thinks that the company will not default or restructure its liabilities. Indeed, the CDS spread can be extremely high in case of financial troubles and a confident investor might be willing to take a short position in CDS.

Conversely, if the investor is bearish and thinks that the company will default, he can take opposite positions, thus shorting the bond or buying CDS.

Capital Structure Arbitrage

Capital Structure Arbitrage means taking positions in multiple securities across the capital structure (either cash securities or derivatives) of a company. In essence, it can be seen as going long one security and short in another one in that same company’s capital structure.

Now we look at some possible capital structure arbitrage trades.

Pari passu securities with different maturities

Securities are defined as pari passu if they bear identical legal obligations and rank equal in the event of bankruptcy, even if they have different maturities. Imagine a company with a senior note due in six months and another one in 5 years with similar nominal value, but trading at different prices. Suppose they trade at different prices. If an investor is confident that the firm would default before the repayment of the upcoming maturity, then he could buy the long-term note and sell the short-term one. In this scenario, the two securities should have the same price, as the respective creditors should rank at the same level in case of bankruptcy. Therefore, the investor will profit from the two prices converging. The initial price discrepancy could have been generated by the market pricing a higher likelihood of refinancing for the short-term note. Indeed, if market participants generally believe the short term bond will be refinanced in the next 6 months (thus delaying the possible default), its price should increase vis-à-vis the long-term bond one due to this “certainty”.

It is thus crucial to have a refined outlook on the company. Indeed, if the company is able to service or to refinance the upcoming obligation, then the investor will bear a loss on the short position, as the bond will converge to par, and a loss on its long position, as more value has been drained from the company, which decreases the ability of the company to service its future obligations.

In other situations, securities could be momentarily considered by the market as pari passu and thus trading at similar prices. Nevertheless, they could reveal different features in a second moment, especially when bankruptcy occurs. This indeed leads to different pricing. For example, this could be the situation when firm A acquires firm B and both have senior unsecured debt. The resulting firm C may become financially distressed at a certain point in time, and the market could price the pre-existing bonds at the same level, as it expects they will be treated in the same manner in case of bankruptcy. However, there could be a rationale in setting up a spread trade. For example, the acquired company, B, could see itself in a better legal position. Imagine it has unencumbered assets and it is not legally forced to guarantee the acquirer’s liabilities: its debt should worth more. If that is the case, the investor would buy the acquired company’s debt and sell the other one. In case he is wrong, the investor incurs only in transaction costs and cost of carry.

Different seniority

Similar trades can be set up between junior and senior securities. This strategy is especially appealing when the credit rating of an investment-grade company is expected to deteriorate. Usually, when such a company is downgraded to high-yield or below, the credit spread between senior and junior bonds increase. Thus, a possible trade would be selling the junior and buying the senior bond.

In general, such a trade should consider the spread between different types of debt (senior, subordinated) and its consistency with the probability of default and with the recovery value. Were the spreads small, and the firm likely to go bankrupt, an investor should short the subordinate bond and buy the senior one. In fact, the price of the subordinate debt will decrease as a consequence of lower expected recovery. The rationale behind this spread trade is that the senior bond’s price will decrease too, but probably with a smaller magnitude.

Equity and debt

Finally, one strategy would be to take opposite positions in the debt and equity markets. This strategy is similar to the one exploiting securities different seniority, as equity lies at the bottom of the capital structure. If the investor believes that the company will go either bankrupt or in restructuring, he may be willing to take a short position in the equity of the company, hedging it with a long position in debt. The investor must take into consideration that the price of debt will fall by less than the value of equity. On the other hand, the main risk of the strategy is a sharp rise in the value of equity, which would wipe out the gains on the bond position. However, even though an equity rally may be less likely, as most of the improvement in the financial position would firstly benefit bonds, the losses on the uncovered short position may erode the gains from bonds. Indeed, an investor may be willing to hedge by buying OTM calls, depending on their expensiveness.

Conclusion

Some of the strategies we presented are not isolated to distressed situations, but they can be extended to companies in good financial shape (e.g. capital structure arbitrage), while others are peculiar of the distressed debt market.

Distressed debt investing provides opportunities for several types of investors, ranging from traditional investment management firms to more complex hedge funds. As a consequence of the risk arising from these uncertain situations and the lack of liquidity of these instruments, returns tend to be quite appetizing and distressed debt can be seen as an attractive asset class.

0 Comments